Silver Lake axis - a silver lining in sight?

Silver Lake axis - a silver lining in sight?

I went to the Silver Lake axis EGM on 01 Mar 2018 to vote for the EGM regarding the acquisition of 3 subsidiaries. To be frank, I half expected a google like buzz and more hip and coming investors and tech geek, being a fintech company and all. In actuality, most of them look like senior citizens at retirement age, some hardcore retail numbers savvy investors, and a few fund managers / securities analyst whom mainly kept silent throughout the egm.

I went to the Silver Lake axis EGM on 01 Mar 2018 to vote for the EGM regarding the acquisition of 3 subsidiaries. To be frank, I half expected a google like buzz and more hip and coming investors and tech geek, being a fintech company and all. In actuality, most of them look like senior citizens at retirement age, some hardcore retail numbers savvy investors, and a few fund managers / securities analyst whom mainly kept silent throughout the egm.

In fact, I think I am the youngest person on the room apart from the ushers. I believe I saw Rusmin Ang, the guy whom wrote articles about agm/egm in his website the fifth person, taking down notes there too. Now without further adieu, I will like to detail on the proceedings of the egm proper.

The first part of the EGM has the main board of directors. They are holding a q and a with shareholders about the acquisitions. The questions are numerous and I took down some of the most important ones detailed below. There was a break for catering whereby the dissapointed aunties and uncles, upon seeing the dismal buffet spread, left in a puff. I went back to the egm to see the eccentric chairman Goh Peng Ooi talking about his business.

The notes I read at the Fifth Person are indeed true. GPO is indeed more of a passionate idealist and theoretical lecturer than a hard nosed business man. He is not exactly good at getting to the point, and more engrossed in his mathematics than real life around him. He is more towards giving a lecture about theoretical mathematics rather than giving a professional egm about his listed company.

In fact, the reason why the chairman is omitted from the first part of the egm, is the fact that he is too long winded and too caught up in his ideals. His board of directors came up with the unconventional egm schedule of a get to the point session first, to satisfy the buffet aunties and uncles, then follow up with the ramblings of GPO for the intellectually curious.

Key points based on my understanding

Key acquisitions

1) Sde - banks are building a digital layer around their core banking systems to provide a digital experience (website / app) . This involves Card processing, payment, retail client on boarding , branch operations, financial products selling

1) Sde - banks are building a digital layer around their core banking systems to provide a digital experience (website / app) . This involves Card processing, payment, retail client on boarding , branch operations, financial products selling

Banks are focusing on the one bank one branch strategy as confirmed by GPO to reduce manpower overheads and rental / branch overheads. Instead of physical branches, they are jumping on the bandwagon and ramping up their digital offering as they have much lower distribution courses.

The management noted a trend that banks are spending more on the digital experience layer rather than core banking systems. As such, they are targeting the small to mid tier banks and acquiring this business.

2) Sop

Rules and alerts. Aml. Monitoring of volatile numbers. Promotions.

Rules and alerts. Aml. Monitoring of volatile numbers. Promotions.

http://www.mas.gov.sg/News-and-Publications/Media-Releases/2017/MAS-Streamlines-Framework-for-Banks-Carrying-On-Permissible-Non-financial-Businesses.aspx

In my opinion, this is something related to the digital lifestyle whereby banks do not simply sell financial products and services, but other products. This is related to the change in regulation by MAS above.

This acquisitions is a Wild factor (higher risk) as subsidary is newly incorporated and cash flow and profitability is still a big issue. I voiced my objection to management regarding this acquisition but they are of the view the long term benefits will work out despite the risks.

3) SDE

IntelliPayz single platform which converges with digital technology to offer mobile wallet payments(namely Google Pay, Apple Pay, AliPay, Wechat Pay, Samsung Pay,et cetera), social payments, and person-to-person payments.. ‘IntelliPayz’ solution also utilises digital security functionalities such as biometric authentication and tokenisation.

IntelliPayz single platform which converges with digital technology to offer mobile wallet payments(namely Google Pay, Apple Pay, AliPay, Wechat Pay, Samsung Pay,et cetera), social payments, and person-to-person payments.. ‘IntelliPayz’ solution also utilises digital security functionalities such as biometric authentication and tokenisation.

IntelliSwitchz’ regional payment switch to facilitate end-to-end cross-border payment transactions. It is embedded with performance and fraud monitoring

This is probably the easiest to understand. It is a kind of middleman software / middleware which talks to all of the relevant payment systems and software to ensure that one app / installation can utilise multiple systems and payment platforms. It is related to some of the banking systems I worked with in the past.

Summary

Management is mainly paying for the growth potential. The earnings and future numbers are mostly projections and I don't like the facts that the acquisition are still loss making / haven't yet proven it's worth.

Management is mainly paying for the growth potential. The earnings and future numbers are mostly projections and I don't like the facts that the acquisition are still loss making / haven't yet proven it's worth.

SWOT analysis

Strengths

The acquisitions and add ons are compatible with bank core system. It does not have compatibility issues across time and other systems. This seem pretty mundane to the layman but based on working with the banking systems in the past, most technology vendors cant even fulfil this basic criteria.

Strengths

The acquisitions and add ons are compatible with bank core system. It does not have compatibility issues across time and other systems. This seem pretty mundane to the layman but based on working with the banking systems in the past, most technology vendors cant even fulfil this basic criteria.

The system is scalable and sufficiently constrained within defined limits so that it can be analysed and limits readjusted so it can scale up and across different business groups. It is not like cryptocurrency whereby people create hope and dreams out of idealism and possibilities , but rather on well defined limits and constraints to provide a solution for the clients. It is so boring and technical to the layman, that even the Caucasian security analysts sitting beside me started to pull out his lab-top and reading up on Creative Technology report by his back end analysts.

GPO as majority shareholder is shareholder friendly and happy with returning dividends to shareholder, share buyback. He is a idealist rather than a businessman. The calls of the company are made by him and luckily the day to day businesses is run by corporate businessmen whom are more in touch with real world.

Increased costs of technology inbuilt within business model. This is a fact.

Weakness

The risk of the acquisitions are substantial as some of them are still loss making. Most of them are of start-up nature and no proven success. Granted there have on-boarded some clients, but there is no sufficient margin of safety.

The risk of the acquisitions are substantial as some of them are still loss making. Most of them are of start-up nature and no proven success. Granted there have on-boarded some clients, but there is no sufficient margin of safety.

These acquisitions are based on growth prospects and even the valuation experts at Deloitte are eager to reiterate the fact that these are guess-estimates rather than accurate projections. I don't like this at all.

According to management, these acquisitions cash flows are >20% recurring revenue, 70% lumpy cash flow and have not sufficiently build up the recurring cash flow portion. There might be bumpy roadblocks ahead after the exciting M&A phase.

Companies are asset light and highly dependant on IP rights. Apple-Creative Technology lawsuits is a sombre reminder of the nature of technological disputes whereby moats are surprisingly thin despite many years of R&D.

Opportunities

Banks are restructuring and riding on the fintech wave due to tightening profit margins and increasingly contested red market.

Banks are restructuring and riding on the fintech wave due to tightening profit margins and increasingly contested red market.

Banks are looking into automation and outsourcing to technology to reduce costs and improve margins.

Banks are looking into personalised digital experiences rather than pushing commodity financial products to the clients.

Threats

A lot of banking system core vendors (infosys, Tata) are aggressively pushing for their product offerings and aggressively trying to capture market share.

A lot of banking system core vendors (infosys, Tata) are aggressively pushing for their product offerings and aggressively trying to capture market share.

New technology developments can make previous products offerings obsolete

There are a lot of Competitors at the appendix, to the point that I am worried the moat of the company is not sufficiently secure, in the fast moving technology industry.

Summary

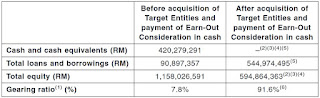

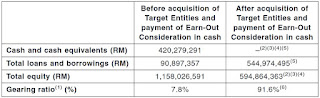

With these acquisitions, there is a sharp increase in net gearing and increased risks in the company. The risks of this company is considerably increased and despite the recent share correction, I will hold off purchase until the acquisitions starts to show results.

Last but no least, No Pic No Talk.

Summary

With these acquisitions, there is a sharp increase in net gearing and increased risks in the company. The risks of this company is considerably increased and despite the recent share correction, I will hold off purchase until the acquisitions starts to show results.

Last but no least, No Pic No Talk.

Comments

Post a Comment