Thoughts on Tax optimisation and Insurance Planning

Thoughts on Tax optimization and Insurance Planning

As the end of year approaches, I have been actively searching for ways to improve my income tax efficiency and also min-max my insurance coverage. Below are some personal notes I observed on how to optimise them. As I am not an insurance agent / financial consultant, there might be gaps of knowledge here and there and this post is merely to consolidate my personal findings for future use.

Personal Income Tax optimization (subject to regulatory change)

1) Instead of focusing on acquiring physical properties for rental income, focus on acquiring REITS with strong financials and robust Funds from operations. This will greatly reduce the tax burden from rental income and concurrently achieve a reliable stream of dividend payouts.

2) Unlike other countries, Singapore does not incur capital gain tax and dividend tax from stock investments. This makes the Singapore citizenship / residency superior for accumulating wealth through investment instruments. Sophisticated investors (like Ray Dalio) even setup their own family office here, and quasi foreign-Singapore citizens (Haidilao founders, Jacky Chan, Facebook co-founder Eduardo Saverin) possesses Singapore citizenship due to the tax advantages they bring.

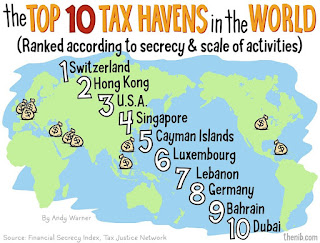

This brings along a possible case whereby in the event the investor wish to emigrate overseas for retirement, it makes strong sense for the investor to retain partial Singapore citizenship due to its tax advantages. Until they are rich enough to hire tax consultants to setup legal entities at the Cayman Islands.

3) Interest payments through saving deposits and CPF are not taxable if they are from an approved Singapore Bank or financial company. Investment in foreign debt instruments are not taxable. However, interest incomes through loans to companies and people are taxable.

From personal painful experience, Personal loans are generally not legally enforceable unless the individual is a licensed moneylender. The police will generally not step in to enforce personal loans between individuals unless it was escalated to the court of law. It makes little financial sense to grant personal loans unless he is willing to mentally write it off (without recourse)

4) Approved donations are a good way to allocate tax savings at a 2.5X multiplier if the taxable person found a worthy cause and an authorized charity organization to donate to.

5) For Personal reliefs, it is subject to the quirks of each household and there is no one size fits all formula. Nonetheless, if the individual has a life insurance plan and has no plans to terminate it, it can be logged for tax relief.

A general good course of action is to top up the CPF RA/SA of your parents to achieve tax savings, followed by your own SA/RA to achieve the target retirement sum. For a young investor, the best way to frame the situation is to allocate capital to a high yield (5%) 50 year risk free bond, whereby it can be treated as your bond allocation in your portfolio. Alternatively, if the investor wants to assist his parents for retirement needs , the payback period is way shorter (10-20 years) for the same risk free rate of return.

Excess sums can be allocated to SRS account for tax savings, but it is up to the investor's ability to reinvest the cash instead of locking it up at a meager rate of return.

Insurance Planning (Subject to my own biased views and possible factual errors)

1) Optimal TPD Insurance

1) From the famous MoneyMind forum in Hardwarezone, the general consensus is that the SAF Group Term Life is the most cost efficient and widest encompassing plan for Total Permanent Disability insurance. Even as I sought the views of financials consultants that I know personally, they could not find any strong problems with its cost effectiveness and extensive wide coverage.

Nonetheless, there is no perfect insurance plan as it is fundamentally an event driven hedge against personal calamities. Common sports injuries like ACL tears are not insured. There is also no way for the insured to make a nomination to decide on the beneficiary, making families with multiple marriages / strained familial relationships difficult to distribute the payouts to.

Also, as a group pooled insurance, in the event there is extensive amount of claims in a specific year, the amount of claimable coverage will be lessened. Still, as the occurrence of TPD claims is generally uncorrelated between individuals, I don't think the likelihood of occurrence is high. In the event of war whereby such an event becomes likely, insurance contractual claims are voided so there is nothing to claim anyway. The Care-shield life is another compulsory insurance scheme for Singaporeans above the age of 30 and there is little incentive to get over-insured in this area.

Term Insurance plans over Whole Life Plans

Buy Term and invest the rest is the philosophy I have adopted after reading the posts of notable financial bloggers like Investment Moats (Keith) and Tree of Prosperity (Chris). I have went through the posts of these astute minds and cross checked with other websites before reaching such a conclusion.

To my understanding, the cash flow allocation of Whole Life Plans are fundamentally flawed as they focus on allocating significant sums to the insurance portion of the product, and also the agent and the managers up the insurance chain. After that, there are huge middlemen fees paid for distribution / feeder fees, platform fees before a single cent is allocated to the stock market. Whatever returns the fund generates, the fund manager still takes a cut, making a insurance linked investment vehicle a supremely mediocre investment vehicle, and possibly explain the historical under performance of the CPF Investment scheme.

A better method is to get simple discrete insurance of TPD /CI/ Hospitalization separately, and separate your investment from insurance. This will ensure the maximum cost effective coverage for your needs. The finance industry is notorious for introducing significant complexity to make their financial products difficult to compare, and earn additional profit margins off what is essentially a commodity product. Some basic knowledge of insurance is important so that you can apply a wind-age factor on whatever financial advice you are getting, so that you cannot be fleeced to overpay for a lifelong expense.

A CI plan is essentially an hedge against income loss due to Critical

illness. If the investor achieves financial freedom early, there is

little need to have a lifelong insurance coverage as the investment

portfolio can generate the returns to sustain his own lifestyle. A term CI plan is superior in my opinion. There is no real need to tag the CI expiry date to any fixed date / retirement

age as these are essentially moving goalposts. Extended coverage

through lifelong plans also comes at significant premiums, with no guarantee of claims as

most people will focus on preventive care / lifestyle changes rather

than go out of the way to attain the mentioned critical illnesses. I notably have a preference of pure multi-claim CI plans over term life plans as I am getting the maximum cost effective coverage from essentially the most expensive insurance type, and lock in a preferential rate before the age of 30. The multi claim portion is important for me as life expectancy is getting longer and CI illness are generally correlated due to specific lifestyle / genetics and can be reoccurring, and I do not want CI coverage to be suspended after making my initial claim.

Conflict of Interest in financial sales industry in Singapore

Due to the flawed mechanics of the financial sales industry in Singapore, most company-sponsored financial advisers / personal bankers are products pushers whom are driven to hit high commission sales targets from their company, rather than introducing the most cost effective product for the client needs. Even worse, I noted the tendency some insurance companies have a cost advantage in a specific type of insurance, but has no cost advantage across other types, essentially forcing me to pick insurance across different providers. As such, I have a slight preference for the services of an independent fee-driven IFA whom can do the cost benefit analysis between different providers. There is also great websites like MoneyOwl that reduce complexity from different insurance packages to core standardized com-parables so that I can make a comparison across the same peer group (similar to a standardized PB multiple).

The below article also highlights the problems with financial sales in Singapore and Hong Kong, and resulted in the exit of Vanguard funds from both regions in recent years.

https://www.asianinvestor.net/article/vanguard-singapore-a-casualty-of-high-fee-fund-selling/446178

Quote

The company has faced other issues since it launched its first

Asia-listed ETF five years ago, principally how to sell retail funds

without paying commissions, in a region that revolves around doing so.

Most funds are sold via commercial bank and private bank salespeople, and their employers "charge significant front-end loads in order to cover the costs of branches, salespeople, systems, and compliance," said Pickerell.

The salespeople typically sell funds that provide the most commission; 'no-load' funds, such as Vanguard's, are not popular. Compounding this, investors don't tend to understand how much front-load funds cost them. Shelly Painter, Vanguard's managing director for Asia in 2013, complained that investors were being misled into believing they were not paying a fee for the products they bought from advisers.

“There is no meaningful no-load fund industry in much of Asia,

particularly in the major markets of Hong Kong and Singapore. Few

investors hunt around looking for good funds with low fees, like they do

in the US," said Pickerell.

Unquote

Read more at: https://www.asianinvestor.net/article/vanguard-singapore-a-casualty-of-high-fee-fund-selling/446178

Conclusion

I have been reading on a lot of literature on non investment related topics and have been taking notes on it. The above is an non-exhaustive summary of the best practices to follow / biggest traps to avoid for young people to optimise their cash flow. As I come across interesting articles, I might blog about it until interesting investment opportunities arrive.

Comments

Post a Comment