Portfolio Review 2020 - Performance Review

Beta = 0.86, VaR = 10.81%,

Expected Shortfall = 17.34%

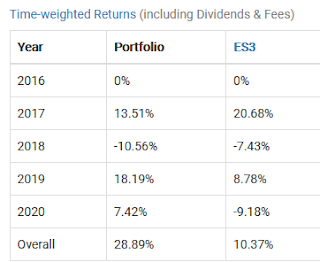

Overall - Time = 28.89%, Xirr = 6.43%

End of year portfolio

Beating the STI ETF

benchmark is not difficult this year. The STI ETF consist of old economy stocks that are most affected by Covid 19, which are greatly affected by the slowdown in global trade flows, global tourism as well as lock-downs in Singapore as well as other countries. Although market commentators like to extrapolate from the US market and preach about the <newfound truth> that <the stock market is not the economy>, I noted that this narrative does not really scale well to other stock markets such as Hong Kong, Singapore, Australia, and other countries.

As I do not base my portfolio decisions on macroeconomic forecasts, market sentiment, or forward-looking / nearsighted / farsighted market narratives, my best interpretation of the situation is that the US stock market simply voted to be optimistic at this moment. I am lucky to have been heavily allocating capital into the stronger global companies since Feb to Oct despite the various doomsayers and market timers on the Internet. Nonetheless, I did not hit any of the superstar stocks like Tesla / Zoom / IPO/ SPACS / SASS stocks that popped during this volatile period, or the crypto space which has significant capital appreciation. My current philosophy is still about minimizing downside risk especially in the frothy US market, but I am considering partial allocation (with portfolio limits) to certain emerging stocks that may have significant growth prospects.

One important observation I learnt about the US market is that my current quantitative filters do not work well in the US market. My allocation to US market is relatively conservative throughout this period as my target price is much lower considering the balance sheet risk, and some of the top franchises did not correct much. Notably, Debt/Equity ratios in the US are out of whack due to heavy use of leverage in the capital structure, especially in some of the well known branded companies. The high debt and heavy share buybacks in 2018-2019 also resulted in companies having negative equity structures, which is puzzling to me as they are not covered in conventional finance. Lastly, heavily indebted companies and the US government went unpunished due to Federal Reserve QE00, and that reshaped investor perceptions that balance sheets / capital structure can be ignored as long as Fed goes BBRRRR. Due to the unique nature of US market, I am considering to prioritize qualitative filters over quantitative metrics specifically for the US market, or simply buy a low cost Irish Domiciled US ETF and avoid over-analyzing the situation.

Holdings Review

Technology and intellectual

property

Tencent

Tencent was a black horse that went unnoticed by most investors until recent coverage by mainstream investment websites . The story didn't change much since 3 years ago. I am bullish about the economics of the various line of business, capital structure, innovation culture and product technical insight by management, its rational acquisition strategy and managerial philosophy, and well as its ability to internally restructure its company divisions to embrace growth and explore new business opportunities. Despite the geopolitical tensions and the political pressure from the China government, I am certain that the prospects of the company are bright, and seek to acquire additional positions if the stock falls to attractive levels.

Microsoft

Microsoft was a stock that I initiated purchase this year despite the rich valuation from a DCF and a multiples perspective. I purchased the stock due to qualitative factors like its strong and increasing market share in cloud computing, growth in console and cloud gaming, strong entrenched base of captive users to progresses from a contractual to SAAS revenue stream, as well as holdings of strategic assets that are core utilities in the Computing world (Github, LinkedIn, Windows, Office, Azure Cloud and Machine Learning Automation, BI data visualization and analytics). I am particularly happy to learn that Satya Nadella is a shrewd and rational capital allocator, as it refrained from purchasing Tiktok (pure user data instead of core technology and trying to outFacebook Facebook) and sticking to core competencies such as expanding its XBox gaming franchises via acquisitions. I noted there is particularly synergy between cloud and gaming whereby improvements in 5G Wifi allows cloud gaming to be feasible and accessible to gamers without high specs PC / consoles, and I expect impressive developments in this area in the near future.

Alphabet

Alphabet is one of the stock that I traded the most as it was in my MayBank Kim Eng account, which incentivize trading 2x per month or 6x per quarter to save on custody fees. The frequent trading of this stock highlighted my current weakness of sticking to target prices of selling normal overvalued stocks when it hits a specific level. For a compounder company that has strong product focus and able to continually increase its lines of business and entrenching its moat, it can continually increase its market share beyond its target prices. I am particularly thrilled about its google Home segment, healthcare linked gadgets and google pay which has strong product focus and branding, and may add more if there is price correction from the antitrust lawsuits. As a decentralized corporate structure, I believe alphabet is able to survive corporate breakups in the worst case scenario, and still emerge stronger regardless of the outcome.

SAP / Silverlake Axis

SAP and silver-lake axis shares the common theme of exceptional sticky software, whereby its captive clients has little ability to switch to other providers once on boarded. SAP is moving towards Cloud Enterprise software while SLA is moving towards open infrastructure core banking systems and insure-tech. I was exceptional lucky to have bought them at low valuations. However SLA went lower and I was worried about it being a value trap if it is unable to increase revenue and win contracts, especially in the environment whereby businesses are cautious about technology capex spending ( This opinion is mirrored throughout multiple earnings call of the companies that I follow). Personally, I am still bullish about these counters and believe the moat is strong, and has compounder potential if it can start winning contracts from existing and new client base.

Exchanges and Financials

HKEX / SGX

HKEX recently beat ten-cent as my top compounder stock so far. I bought the stock approximately 2 years ago as market commentators are bemoaning about obseletion of HKEX and the potential disruption via SZEX and SHEX and Macau. I believe the moat of HKEX is not threatened as there is investor perception about superior visibility in the globalized HKEX, and Hong Kong market structures that cannot be easily replicated (Globalized free tradable currency, entrenched contractual terms and legal frameworks). Trump sent me a parting gift by forcing the US listed china companies to be dual listed in HK, and HKEX has also continually improved its market practices to list the booming tech companies from the mainland, rapidly increasing its listing revenue. IMHO, this is a positive flywheel effect whereby there is boom in listing fees, increased interest in the northbound / southbound stock/bond/ETF connect, increased ecosystem of stocks which improve trading volume and investor interest via HKEX, premium branding of the Nasdaq of the East, and liberalizing of the CN finance industry as companies move from bank linked Loans to issuance of tradable corporate bonds.

SGX is mainly a cheap compounder that has strong growth prospects from its derivatives exchanges as well as potential growth from the crypto exchange collaboration with DBS. I expect the Geo-political risks and price volatility among all asset classes to be continual 2021 and beyond, prompting the demand for risk management / exposure throughout different asset classes. There is interesting developments in the index licensing business and collaboration with Nasdaq on trading links, and I look forward to see how the story plays out.

OCBC

I did not see any major change in OCBC throughout this period. As an interest rate cyclical, I did not average down from Mar to Nov as I am unsure about the disruption posed by the digital banks and PFOF brokers, and expect tightening interest rate margins for a significant period. On the other hand, OCBC is heavy on digitalising its process and converting physical branches to improve efficiency and save on manpower costs. There will be significant structural changes in the banking space and I am trying to discern if I have superior insights in the mega-trends that are present in this space.

ETF and mega-trends

CSI 300 ETF / ishares Hang Seng Tech ETF

I am very bullish about the recovery of the China economy as the recovery is well backed by the fundamentals, and production and consumption (real economy data) has recovered to precovid levels. The main thesis of China as the main factory of the world is not impaired and domestic consumption and spending trends are set to increase as international travel is halted. I am particularly bullish on the tailwinds of China tech companies as they have structured their entire economy and education system to support the growth of mainland tech companies, and designed significant overhauls to prevent unfair monopolistic practices of the giants to squash the smaller startups. However, as the corporate governance standards, financial statements ambiguity and political risk in China is significant, my choice of exposure is still through an ETF approach unless I have special insight in the companies I choose to invest in.

Berkshire Hathaway

As BK-B long reached megacap status and is based on old economy companies, I do not think its market beating performance can be replicated consistently compared to its younger days. Nonetheless, I immensely like its USD128 billion war chest, its decentralized culture to prevent bureaucracy and unnecessary expenses, its rational acquisition and divestment framework, its rational compensation and ownership culture to retain good managers, and the unique ability to tap on insurance float (with superior underwriting results), decentralize operations, and centralize cash flow management within its structure to earn tax benefits and reinvest in highest growth areas. Even if the Berkshire Pair retires from being the figureheads of the company, it is unlikely that operations will be affected.

Healthcare and Death-care

Fu Shou Yuan

FSY seen a drop after some insiders liquidated a portion of their holdings. Personally, I believe the addressable market of the company is still strong and the market share is growing as it acquire the mum and pop providers. The company is shrewd at navigating the regulated industry and winning contracts from the municipal governments, and contributed to CSR to win goodwill among retail and government clients. What is particularly impressive is its innovation in cloud-remembrance services, whereby 清明扫墓 services grew under covid conditions, and family members can install memorabilia and other pictures / videos to remember their loved ones. Due to the morbid nature of the industry, I do not see major competitors coming into this regulated industry and that serves as a moat in this high margin business.

Raffles Medical

I have up-sized my position in RM at Feb this year as a hedge against worsening covid situations in China / Globally as I expected increased hospitalization and clinic visits due to the viral spread. Most unexpectedly, China turned out to be the best performing country in covid management compared to the highly developed western counterparts. I removed the hedge as the business of RM is still largely dependant on high margin hospitals and surgeries which has significantly slowed down, and there is potential disruption in its low margin clinic business due to telemedicine apps from JD, Tencent and Alibaba. The capital structure is still reasonably strong to buffer against the cash burn from its hospitals and I see good potential prospects from CQ and SH in the long term. I look forward towards updates in this area.

Comparing my hedge to Bill Ackman, he was shrewd to put on a credit default swap to hedge against bond default risks, and diverted widespread media coverage from his losing streak to executing the greatest trade ever. He also ploughed his massive gains into the stock market at March, instead of averaging out his purchases, resulting in a 62% return this year. Despite him humble bragging about being lucky and it being a 10 min decision to buy cheap insurance compared to his other trades, I believe his compounded wealth of experience, triumphs and failures led him to put on that specific hedge compared to mainstream SandP puts. Investing is an odd combination of skill and luck, and it is hard to discern the difference among truly skilled investors in the short run.

Consumer Brands

Yum China

Yum China is a company I have watched since it was spun off from Yum Brands. Its Glocalised strategy is well regarded among foreign visitors into China, with its unique products that are catered to local tastes. I have studied the history of the company and was impressed by the turnaround by Joey Wut to refresh the aging brand, and incorporate CSR intiatives, robo-delivery marketing campaigns as well as incorporate subscription services to entrench China consumers into the wide product lines. Its multi brand strategy is still at its early stage, while the main KFC Pizza Hut Brands carries certain foreign prestige enabling it to have higher than market profit margins and pricing power. I like the humble beginnings of Joey Wut and her management philosophy manged to win over her employees' heart and minds. The management compensation structure is also well aligned with longer term shareholders, with a combination of long term share options compensation and insider holdings of stock. As a simple understandable free cash flow generative business which is profitable, it is able to clone ideas / products once they are deemed successful, and rapidly open branches throughout uncontested cities to rapidly scale revenue and profits.

REITS and Real estate

Deep Value holdings

Hong Kong Land / Stanford Land

I initially bought these 2 counters as an asset play, whereby there is severe undervaluation based on its book value (cash position + buildings). Properties are a mainstay regardless of economic conditions and a good inflation hedge, and I believe the company's balance sheet can well support its debt levels through covid. Nonetheless, Stanford land (hospitality) is suffering through severe economic headwinds and as a micro-cap it can be extremely illiquid. HKL may turn out to be a value trap and face headwinds from reduced office space rental, but I don't think the long term demand of premium property location will be severely impeded in the land scarce Hong Kong and other prime locations across Asia.

REITS

Frasers Center-point trust (Retail Shopping REITs)

Ascendas India Trust (Business Process outsourcing, technology and IT, and logistic REITs)

Ascendas REIT (Global logistics REITs)

As a favored asset class in Singapore, the REIT structure has immense tailwinds from the lowered interest rate conditions throughout the world, making it cheaper to refinance the property and operations. I picked the REITS which gearing is not excessive and has a healthy balance sheet to survive unexpected events. As long as the tenants are willing and able to fulfill the rental obligations, the long term economics of the REIT is not impaired.

I believe FCT is not disrupted from eCommerce due to its advantages in experiential malls, as evidenced by the DAU/MAU of human traffic in its flagship malls such as Causeway Point and North-point. I am happy about the management's rational and opportunistic divestment of under-performing malls and acquisitions of yield accretive shopping malls around Singapore. AIT is not disrupted be WFH as business outsourcing plans remain intact, IT and technology outsourcing serves as captive clients to the REIT, and the strategic diversified locations of the buildings through India's special economic zones acts as a price floor to the buildings asset value and made me optimistic about its long term outlook. Ascendas REIT had proved to be skillful in maneuvering the logistics space, but due to limited visibility in this area, I did not average up despite my initial purchase 4 years ago.

Greatest Lessons in 2020

1) 未雨绸缪 (Importance of building up a warchest and Watch-list)

The key constraint for me is warchest size and not the absence of opportunities, as my investible universe is across 4 markets. Despite accumulating a warchest for close to 7 months, the limited savings I accumulated is insufficient to capitalize on the downpour of opportunities that came. I was lucky that I had a CPF backup warchest and managed to grab some SG stocks while reserving the bulk of it to foreign counters. My HKD portfolio is the best performing, followed by the USD portfolio, and lastly the SGD (Value trapped) portfolio.

I can continually buildup a investible universe while I uninstall my broker app, and reinstall it when the time comes. I need to be more disciplined in allocating capital and wait for the big fat pitch whereby there is a great business with a margin of safety. I need to be patient enough to wait indefinitely for opportunities, and aggressively

deploy capital when the moment comes. I might want to spend more time on my CFA preparation or get some gigs to earn alternative income streams to channel into my warchest.

For my personal style of investing, there is no point betting on

low conviction companies which only increase transaction costs and foster a short term attitude. I will instead focus on Mid and high conviction positions to companies which have lots of potential but has temporary company specific issue.

(Valuation risk, unclear situation but pass the checklist test)

2) Develop a robust investment philosophy

Every serious investor needs a clear Direction / True North so that maniac depressive market will not

disorientate you on the way you invest. For me, I need to have a clear thesis on why I invest in each company and what makes it unique.

If it is a quality company / compounder, don't sell the stock even when it is

moving from cheap to expensive.

If it is just a cheap stock with real problems, be prepared to sell when it moves from cheap to

fair value.

If the thesis is wrong, be prepared to sell.

If I am mentally prepared to write-off /

make charitable contributions while

taking position on a high risk stock, I will make a mental note to ride it to the bitter end.

3) Due to over-watched nature of the US market. there is no harm buying a low cost

Irish domiciled ETF

Price shocks are quickly caught on and great buying opportunities last for very

brief moments. It might take me too long to analyse before the market catches on to it. As too many full

time analysts are watching it too closely, I am unlikely to achieve alpha. The existence of modern internet has democratized investment analysis and valuation as I am able to get valuation and resources too easily from YouTube, Blogs and Professional

investors.

4) The need to

reduce Churn.

I bought and sold more times this year than previous 3 years combined, which is a combined result of market volatility as well as my migration from SCB to MayBank KE. May-bank KE has an incentive structure to promote frequent stock trading. Due to workplace limitations, I am stuck with this broker for my entire portfolio needs and need to design a new trading plan to optimise my commission / custody spend.

2 Trades a month

Average up/down on stock in 2 tranches

Sell a deteriorating stock, and buy a improving one.

6 trades at once.

When the market is freefallling.

5) Portfolio management rules may limit the potential amount of returns you get,

but it will also protect you from catastrophic losses.

As investing is ultimately a probabilistic game, there is no way to perfectly predict the outcomes despite the amount of conviction the investor has. At the risk of hindsight bias, I did not add enough to Tencent and

HKEX as my portfolio is too small when I started out, which turned out to be great com-pounders. On the other hand, I bought too much SLA which could be potential value trap despite my optimism on its full

potential.

I have a Bias on betting on companies with strong moats (limited operational and financial risk), and ignoring mega-growth stocks which has thin moats. The focus is on reducing the downside so that what I capture is only the upside. However, as technology erodes the moats of traditional companies, there are companies that have good fundamentals and huge growth potential despite huge valuation / company specific risk. As no-one has invented a method to time travel and buy TheTradeDesk/ Zoom pre-covid, or Microsoft when it first IPOed, I need to guard against the destructive behaviour of FOMO. Instead of lamenting on all the opportunities I missed, I need to learn to shoot better the next time round. In the future, I might risk-manage mega-growth companies via mid conviction thresholds in my portfolio, and learn to buy the company at lofty valuations and ride it out provided that I truly believe it can grow to its full market potential.

Comments

Post a Comment