Portfolio Review 2020 - Performance Review

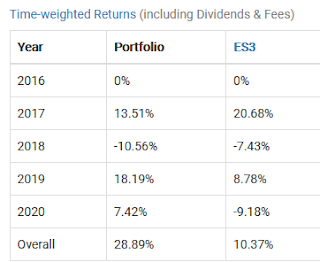

Quantitative measures Beta = 0.86, VaR = 10.81%, Expected Shortfall = 17.34% Overall - Time = 28.89%, Xirr = 6.43% End of year portfolio Beating the STI ETF benchmark is not difficult this year. The STI ETF consist of old economy stocks that are most affected by Covid 19, which are greatly affected by the slowdown in global trade flows, global tourism as well as lock-downs in Singapore as well as other countries. Although market commentators like to extrapolate from the US market and preach about the <newfound truth> that <the stock market is not the economy>, I noted that this narrative does not really scale well to other stock markets such as Hong Kong, Singapore, Australia, and other countries. As I do not base my portfolio decisions on macroeconomic forecasts, market sentiment, or forward-looking / nearsighted / farsighted market narratives, my best interpretation of the situation is that the US stock market simply voted to be optimistic at this mom...