Portfolio Review 2021 - Performance Review

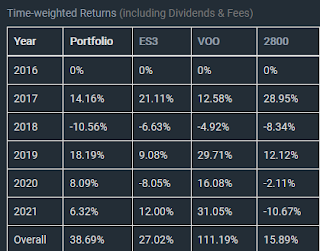

Added TWR breakdown by market performance as my portfolio ventured outside SG Quantitative Measures Beta = 1.06, VaR = 12.60% Expected Shortfall = 19.57% TWR = 38.69%, XIRR = 7.90% End of Year review 2021 is an eventful year marked by huge market volatility in all asset classes. The surge in interest of retail trading / investment in US markets brought markets to speculative highs in loss making zero / minimal revenue companies, and the announcing of the interest rate tapering brought stocks to more attractive valuations at year end. Momentum stocks / shitcoins / China crackdowns took turns dominating the headlines as the financial media (similar to Facebook) is incentivized to optimise for clicks and hype and not about solid fundamental changes in the underlying asset. A lot of unusual speculative quirks happened in the financial markets which forced me to reassess my basic assumptions about conventional financial wisdom. Some memorable events that surfaced this year are i)...