Portfolio Review 2021 - Performance Review

Added TWR breakdown by market performance as my portfolio ventured outside SG

Quantitative Measures

Beta = 1.06, VaR = 12.60%

Expected Shortfall = 19.57%

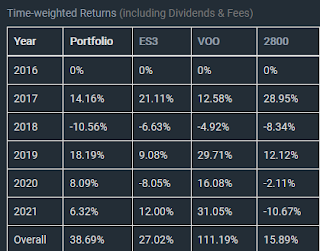

TWR = 38.69%, XIRR = 7.90%

End of Year review

2021 is an eventful year marked by huge market volatility in all asset classes. The surge in interest of retail trading / investment in US markets brought markets to speculative highs in loss making zero / minimal revenue companies, and the announcing of the interest rate tapering brought stocks to more attractive valuations at year end. Momentum stocks / shitcoins / China crackdowns took turns dominating the headlines as the financial media (similar to Facebook) is incentivized to optimise for clicks and hype and not about solid fundamental changes in the underlying asset. A lot of unusual speculative quirks happened in the financial markets which forced me to reassess my basic assumptions about conventional financial wisdom.

Some memorable events that surfaced this year are

i) The coordination of the <mother of all short squeeze> on reddit WSB

Social media twitter and reddit WSB created <closed feedback loops> and pumped the price of companies in financial distress like AMC / Gamestop into speculative highs through coordinated rumor mongering to shore up the stock price, in a bid by retail investors to <save the company from bankruptcy>, when in actual fact the share price usually do not usually affect the fundamentals from the company and is mainly the priced in expectations of market participants. Most unusually, the reflexivity and self fulfilling prophecy effect allowed the company to massively dilute the overvalued stocks in exchange for cash, saving the company from bankruptcy and restructure the old management to embrace a new operating model. Individual stocks can perform in most unexpected ways if it is not trading based on fundamentals. This incident also challenged the conventional view that retail trading is market neutral in general, and is a reminder that exceptional unlikely scenarios can occur repeatedly in financial markets.

ii) The cult of personality and the <Elon-Musk-Hype-othesis>

Certain companies have innovated an unprecedented capital raising strategy by focusing on social media (charismatic CEOs), retail product presence (shoppee), and huge top line revenue numbers to attract newly minted investors to push up the value of their stocks, diluting their existing shareholders to raise cash for their operations. This <cash infusion technique> in turn is used to fund their operations and hopefully grow large enough to attempt to achieve profitability, network effects and operational leverage. Although they are credible analyst / investors whom have superior insight on how certain loss making businesses have a route to profitability and is simply compressing current margins to heavily reinvest for growth, they are also a horde of quacks whom regugigate the amazon miracle story to justify whatever company they wish to shill to execute pump and dumps. I do not think I have superior insight in most businesses and I will tread very carefully in this jungle.

iii) The increased interest in alternate asset classes

Blank Cheque companies <SPACS>, NFTs and shitcoins also monetized the <ThereIsNoAlternative> narrative whereby sponsors market their SPACS through <social influenzas> with no background or track record in investing, to lure in inexperienced investors into buying up the asset. The SPACs have an unusually perverse incentive structure to overcompensate the Sponsors once they complete the deal regardless of the quality of the purchase. The nature of the shitcoins ponzi economics and the siren of fast riches by dubious promoters into squid coin, floki inu, Tether, millionaire token is revolting, and tainting the reputation of the asset class. I personally believe there are credible underlying projects and there is aggressive talent poaching from traditional financial institutions to blockchain project development, accelerating the growth of crypto from lines of code to 16th century finance in a matter of years. However, it is too hard for me to sieve out the wheat from the chaff at present.

Performance Review for 2021

My portfolio performance is mediocre this year as I heavily averaged down into HK/China market during the market correction which has not recovered from the depressed lows. I do not want to be a closet index investor and is tolerant of deviation from the indexes to attempt to achieve long term superior performance, and is still bullish about the long term growth prospects in this geographical area. Although the US piece of my portfolio did decently thanks to Microsoft Google and TTD, most of my recent purchases only occurred on December crash and it is too short a period to judge

whether the new picks contributed positively, especially since I believe

that I can only know the quality of the decision 3-5 years out.

I believe a know nothing investor should invest in the unmanaged low cost SandP500 / Global index fund and as the input/reward ratio is staggering compare to active investing and the index funds do hold some of the strongest companies in the world. The SandP500 ETF do seem to be almost an ultra performer and fully information efficient in the large cap space (with high volatility swings upon market changing data) due to the huge scrutiny of both retail and institutional investors. However, there are structural issues with the bottom up analysis and debt level of the SandP constituents that I am not too comfortable investing in, and I do have an interest in learning more about active investing currently. This might be an irrational behavioral bias that I may seek to correct and I will encourage most retail investors to invest in the SandP to reach 7K MMR and beat 90% of professional fund managers and competitive scene out there. Not everyone has the stomach for high variance FiftEE-FiftEE fund managers, or closet index investors whom over-diversify to mediocrity and are weighed down by high trading / management fees without the low tax / cost advantages of the Vanguard/Black-rock ETF structure.

Portfolio Review

Software and Intellectual Property

Tencent Tencent is one of my highest conviction

position as I averaged down on it continually since the start of the

China tech crackdowns. Regarding the crackdown on the gaming division, I

believe the current profitability will not be majorly hampered as most

of the paying users are not impacted. Minors aged under 18 only accounted for 6% of Tencent's China online game gross receipts, among which, minors aged under 16 accounted for 3.2%. The crackdown in game time will force minors to

reallocate their gaming time from low tier casual games to higher tier

immersive games and the fear mongering headlines are harping on the

wrong metrics. Regarding the future growth rates of gaming users in

China however, there will be slowdown due to the restrictions of game

app distributions and advertising, and tencent acknowledges this problem

by segmenting its global games from its China games classification, and

began aggressively growing its global gaming studios and franchises

through acquisitions overseas. The unique aspect about tencent is its

superb capital allocation ability whereby it shrewdly reallocate the huge

cash flow generated from its lucrative gaming franchises and commits heavy

reinvestment in high roic areas like software, cloud and industrial

iot, instead of the diwosification tenancies of Alibaba

management into low margin areas. The

WeChat ecosystem and app store is the strongest moat of ten-cent as the Tencent has the discipline to deter from overt monetisation of the ux via

advertisements, resulting in an entrenched user-base whose personal interactions will not be plastered by annoying ads. Tencent instead

pushes its eyeballs and MAU/DAU into its investees to boost their growth

(unlike Baba whom pull eyeballs from investees to taobao) , making it a

premium investor for startup founders seeking to grow their companies, and reducing the conflict of interest (attention and eyeballs) between investor and investees. Tencent

most remarkably has one of the most successful venture capital arm in

the world and its investments in companies such as NIO, JD.com, PDD,

Meituan, Tesla, Reddit, UMG makes its (cash and investment position)

worth more than its stated nominal value. Its decentralized ownership structure is similar to Berkshire Hathaway

whereby it does not take on the unique business risks and capitalization

risk on it's balance sheet, or complex business risks from manpower

intensive lower margin companies such as meituan JD nio. By not

micromanaging its champions, they are free to unleash their full ability

free of executive meddling. Although I have high conviction in my

analysis, I will be exceptionally wary if the China government does

executive meddling on tencent core management which may impair the

flywheel effect. Microsoft Satya

Nadella has successfully executed the turnaround from Steve balmer days

whereby it decided to refocus on its strongest core competence and and

not engage in the sunk cost fallacy. By cutting loss on Nokia and other

failing acquisitions and deterring from diwosifications like tiktok, it

decided to focus on its gaming franchises and office productivity

software. What is amazing is that MSFT manage to re-energise its

consumer franchises and made its hardware devices (surface lab-tops and

pens) fashionable and chic and Xbox consoles (Model S Model X) in high

demand. There is technology leadership in cloud computing and cloud

gaming as well as plans to incorporation meta-verse tools into business

meetings (integrated with linkedin details). Most importantly, Microsoft

managed to successfully switch its captive users from a software

licensing business to SAAS model, resulting in its future cash flows to

be strong and robust moving forward. SAP / Silverlake AxisSAP

and silverlake axis shares the theme of exceptional sticky software

whereby they are the core operating systems of the company / Bank. SAP

is copying Microsoft strategy of converting from its licensing model to

SAAS cloud model to unlock robust cash flow in the future and improve on

regular updates. Due to the stickiness of the software I am reasonably

confident it can succeed and will periodically monitor for updates.For

core banking, silverlake axis managed to regain momentum of winning

core banking projects and the cash flows should be recognised in its

future earnings, but the share price remains in the doldrums as it is

listed as a mid cap in Singapore market with poor investor visibility,

relatively illiquid and family controlled. I believe traditional banks

will be forced to upgrade their core banking suite to be API and cloud

compatible (like OCBC and UOB TMRW) and migrate to digital banking and

they cannot deter core banking capex indefinitely, or suffer from

continual service outages like Deutsche Bank BNYM and DBS. Nonetheless,

if growth does not materialise within the next 4 years, it might be a

value trap and I will need to cut loss and reduce my opportunity cost. Alphabet / The Trade DeskAlphabet

derives the majority of its income from advertising revenue and is one

of the gateways to the internet with its dominance in search. Its

Alpha-bets continue to defy the odds and spawn new emerging business's

that are hard to create but has huge addressable markets, may it be

Google pay (control of the client relationship and using txn data to

monetise ads), Google map and ads, waymo level 4 self driving (hard to

create but capex light exposure to autonomous driving), quantum

computing (moonshot) and YouTube (ever increasing content base with a

flywheel of generating more entrenched subscribed users, incentivised

quality creators, and ad revenue and targeting). Alphabet is

surprisingly tight lipped on its metaverse plans despite being a leader

on Google glass and there might be potential surprises moving forward. While

Alphabet apple Amazon double downs on its walled gardens to improve

monetisation of its entrenched users, TTD avoids the sharks and swims

out to capture the rest of the internet. By positioning itself as a

prime broker for high value ad clients and with a vertically integrated

broker-exchange model (reducing conflict of interest) , it attempts to

network with the rapidly growing advertising white space (connected TV,

alphabet Amazon apple properties, China market, Spotify tiktok and

emerging social media platforms, radio and traditional media) and

linking all the ad inventory into its platform. Advertisers can then execute

highly targeted and flexible ad spend and strategies, and closely monitor the effectiveness trough its marketing analytics tools. Its leadership in

ad tech specs seems promising despite the heavy competition and apple

restrictions on data collection and it became one of my best performing

position along with Microsoft this year, MeituanMeituan

follows a Groupon model whereby instead of competing in increasing capex intensive

and price sensitive e-commerce industry, it takes on areas it can provide superior value proposition from competition, to incentivize users to travel out to malls / advertised shops and

service providers (movies massages, tourism areas, hotels) and builds up

its emerging business such as retail POS systems (within the smartphone

/ computer without the hardware infrastructure). Its growth trajectory is similar to costco / amazon whereby it seeks to capture a large community of users with irrestible deals, improve the client stickiness with last mile delivery on

food and fresh groceries, and group buying businesses, and adopts a horizontal expansion model to capture new markets. <If we build it, they will come>. Its last mile delivery has horrific margins and there will be headwinds due to china crackdown on its rider treatment practices. Its higher margin

business are in hotel and travel booking which is recovering as China

gradually resumes domestic travel. Nonetheless, the omnicron varient and zero

covid policy will present lumpy headwinds on its high margin business, but it

should have the cash position to buffer through this period while

continue to grow as a superapp. Although the business has

surfaced as the sole winner of the thousand Groupon war, it's cash burn

is still concerning and I will periodically monitor for updates.

Financials

Paypal

I averaged down gradually on Paypal upon the lowered revenue guidance in the most recent quarterly reports. My understanding of consumer behaviour and retail spending habits led me to conclude that the trend from cash towards digital payment is inevitable. Paypal has strong stickiness and growth in its legacy business for business transactions, and strong growth prospects in Venmo retail transactions, dominating 50% of US market. Paypal has a lot of optionality in areas like cryptocurrency access for retail investors, and its business model revenues directly scales with inflation which I believe is not transitory, and hard to reign in. Retail consumer spending in the US is one of the strongest in recent years due to Helicopter money, aggressive fiscal spending and generous benefits from the US government, and I believe the revenue miss is transitory as Paypal migrated from EBay to Amazon to capture the ever increasing payments volume and GMV in the amazon ecosystem.

What I like most about Paypal is its financial health and cleanliness of its balance sheet, and the use of free cash flow generation ability as a key metric in its investor presentations. With its large captive users from legacy Paypal and lowered user acquisition cost from viral Venmo, I believe this is a superior business model compared to Block(Sqaure), which is not strong in these metrics. Additionally, by controlling the direct client relationship to the underlying client, the risk of commoditization of its payment network is lower as it has huge sets of granular transaction data to be analyzed and monetized in multiple formats and up-sell new goods and services to its clients. This makes it a superior business to back-end payment processors like Mastercard/Visa, which are facing headwinds in improving profit margins.

SGX/HKEX /Coinbase

Betting on exchanges is a direct bet on increasing volatility in various asset classes. The thesis of SGX is its unique positioning in APAC time zone at an important financial hub, There is misvalued investor perception of SGX as a stock exchange (dead scene and losing listings to HK/US) whereby in fact it is transitioning to a multi-asset exchange with a focus on growth in derivatives volume, Bond raising, India / Nasdaq trading links, and emerging areas like crypto exchange. As most of SGX is bought using CPF funds at depressed valuations , I find the downside and opportunity cost to limited and it can confidently achieve a rate of return about the CPF 4%OA

HKEX remains one of the premier capital raising exchanges in APAC, with a strong base of potential listings from Mainland china, whom wants to raise capital and be marketed as a global company. Due to US/CN tensions and the pressure towards delisting US listed china companies and force them back to HK/CN, HKEX is enjoying tremendous tailwinds and is currently trading at reasonable valuation compared to its future cash flows. HKEX is also benefiting from unprecedented volatility in the stock market and the China A50 derivatives suites and I am confident of its future prospects.

Coinbase is an unique business model which consists of a Neo-Bank vertically integrated with a Broker-Dealer exchange. It is positioned as one of the few legally permissible crypto exchanges by the US SEC providing it with a first mover advantage and prime broker for institutional investors seeking to gain exposure to cryptocurrency and blockchain projects. With the Wild west nature, ponzi scams, pump and dumps, and crypto heists from various crypto exchanges, coin-base focuses on auditing /screening of its advertised assets (USDT) and provide high grade secure custody services compared to other exchanges, positioning itself as a major player in the development and acceptance of crypto/blockchain by institutional investors.

What is refreshing about Coinbase is its stand to avoid provocative advertisements but rather educating investors about each unique listed asset. I liked the straightforward communication of the product-manager founder CEO, the cleanliness of its balance sheet, and the business cash flow generation ability and reinvestment opportunities. Coin-base reviews and onboards respective cryptos and blockchain project on its individual merits before listing them on its platform, providing a layer of KYC/AML for investors which legitimize the individual currency / project. This potentially makes them a premium listing location for developers artists / projects that genuinely intend to build new technologies instead of pumping their crypto for a fast buck. Its crypto developer hub has potential in developing blockchain projects into applied technologies. As I believe in the potential of blockchain projects but is unable to ascertain any value for the individual coins, it will be easier to monetize from crypto volatility than take active risk in something I cannot value properly.

OCBC

OCBC is a legacy position from my early investment days that does not have a unique business model, but is one of the better run banks with strong cost discipline and an above average ROA in Singapore. I was simply banking on the eventual higher interest rates and economic recovery and hopefully divest it slowly at a reasonable return.

Diversified holdings

Berkshire Hathaway

Berkshire Hathaway is an unique investment vehicle with investment float as safe leverage and has permanent capital structure. I believe Buffett and his handpicked successors are one of the most skilled capital allocators in the US and have superior insight in the US investment space. Although they missed the boat at Mar2020 and failed to deploy their USD126 billion warchest, I believe the quality of businesses within berkshire is of higher quality than the SandP index and they can find reinvestment opportunities within their operational business, outside US, or aggressive share buybacks. I do not have insight on the capital intensive railway business or the energy industry that Berkshire allocated a lot of capital too, and I look forward to successor managers to execute and hopefully bring results.

Hang Seng Tech ETF

The bet on Hang Seng Tech ETF is based on the CCP White paper to achieve technological leadership in certain areas and chip independence, as well as to achieve a broad based exposure to China tech companies, that I am interested in owning with huge markets to grow to. I averaged down until I hit my portfolio allocation limits and it has not recovered from its depressed lows. I believe the CCP is squeezing the companies to ensure that they understand who is in control, but they have no incentive to kill their home champions, especially since they have ambitious plans to be a technology leader. I hope that the tech crackdowns will be more lenient after XiJinPing secures his election in the politburo but I have no superior insight on how the events will play out.

Property

Ascendas India Trust

India remains as one of the top outsourcing / offshoring locations for back office, technology and financial services in the world. India was noticeably hit hard by covid due to the underdeveloped healthcare sector, and the sheer size of the populace. I do not think the cash flows of the underlying REIT will be impaired as the cost-benefit of lower wage educated workers are still attractive to MNCs, but there might be forex risk that may be underhedged due to massive QE actions by the Fed. AIT is still heavily reinvesting in infrastructure projects to continue to grow despite covid worries. Despite potential delays in the completion of the building plans, I remain bullish on its prospect and will monitor for updates.

Frasers Centerpoint trust

Frasers Centerpoint Trust remains an undervalued REIT which is able to secure stable cash flows from its uncontested prime shopping locations in the North, leading to its strong rental negotiation advantages against the leasees. The managers took measures to divest under-performing malls (Bedok mall), and tapped into the capital markets to acquire strategic malls (white sands) and across Singapore. As the Singapore government handled the covid situation poorly, there might be limited tourism with high spending power coming into Singapore in the next few years. I believe that the downside is protected but the upside is not so certain in the next 3-5 years.

Consumer Brands

Yum CN

My understanding of the fast food industry is that it is a higher margin, high scalability and duplicable business, with reasonable manpower costs and strong pricing power. Chicken is inherently a product with zero taste memory and can be prepared /enjoyed in many ways, and Yum CN g-localised and innovated Chinese version of top selling and healthier products, and managed to reenergise the aging brand. However, the covid zero policy by the CCP punished the retail sector in China heavily as the districts switched between abrupt lockdowns and quarantines. Companies such as hotpot restaurant HaidiLao and Yum Cn are hit hard, but I believe the Yum CN model is more flexible and suited to dine in and takeaway options.Yum CN is acquiring restaurants at strategic locations to capture higher visitor flows, and is partnered with meituan to ensure the food delivery quality standards are consistent. Compared to HaidiLao, YumCN is better capitalized and has far greater cost discipline and service quality standards in its expansion plans.

Monster beverage

Monster Beverage services a niche space in the energy drink market, with a strong consumer brand through targeting the younger audience through esports and physical outdoor event. An interesting fact is that the top managers of coca cola chose to divest their parent company stock and chose to invest in Monster beverage. Monster beverage is an exceptionally asset light model whereby it only deals with creating new flavours, design and marketing while the production and distribution of its products is thorough the coca cola network. Its balance sheet and cash flows are robust, but I expect headwinds in production and distribution due to covid affecting shipping networks and supply chains, and increasing the cost of transportation and distribution. Nonetheless, soft brand franchises have strong pricing power as observed in supermarket prices and I do not think the business will be heavily impaired.

Deathcare

Fu Shou Yuan

China is one of the best performing countries in terms of infection and death rates for covid. Unlike US and Europe listed deathcare companies like service corp which are printing money faster than JPow, FSY did not have a major boost to its top line revenue, and its share price languished due to lowered valuation multiples of its business. My original thesis is about the total addressable market of the increasingly affluent Chinese population and not from a temporary boost to covid, so I do not see any reason to sell the stock. Deathcare remains as one of the best business with superior margins, low risk of failure, culture quirks which prevent foreign companies from competing, and unlikely to be a hot industry that will attract disruption by technology. I do not have superior insight about its <cloud memorabilia storage > business and updates of its acquisition plans, and I will check in for updates.

Conclusion

This year has been a wild ride. To most people, the stock market is their wildest cheerleader when it is climbing up, and the harshest persecutor when it is crashing down. For me, I was lucky and disciplined enough to maintain a watchest, and managed to deploy it at year end. I allocated more money to the stock market in a single month than any other time in my life, and there were times whereby I think I was going too fast, as the stock market can always continue to go lower.

The year of the bull is over. Next year is the year of the Tiger. Exciting times ahead.

Comments

Post a Comment