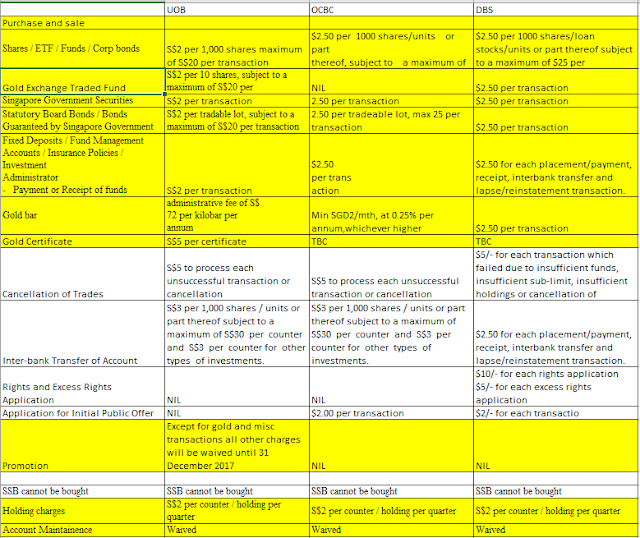

Comparision of SRS across providers

I am conducting an independent Analysis of SRS across providers, as the information of the Internet is incredibly lacking. Effective on year 2017, this is a table summarising the relevant charges to be expected before one undertakes account opening decision. This is to be used as a general guide of comparison and there might be errors. If anyone wishes to clarify on the above claims, he should speak to his respective bank's banker.

1) For the purpose of investing via SRS, UOB has ongoing promotion of waiving of charges until 31 Dec 2017.

2) Sources

http://uob.com.sg/assets/pdfs/SRS_Charges.pdf

https://www.ocbc.com/assets/pdf/investment/cpfia_schedule_of_charges_201112.pdf

https://www.dbs.com.sg/iwov-resources/pdf/invest/supplementary-retirement-scheme/srs_schedule_of_charges.pdf

3) Generally, for my own investment methodology (strongly inclined towards stocks and REIT)

i) Shares, ETFs and Corp bonds = UOB

ii)Singapore Government Securities = UOB

4) After speaking with the uob bankers, for uob srs, there will be no account maintainence charges. There will be no holding charges if I hold the account as cash and no other securities. There is no minimum balance to maintain and I can let it lay dormant for years without penalties.

For 2016 and 2017, the promotion is indeed valid and most charges are waived off except for the gold and misc charges.

However, the bank side is promoting the sale of their fixed deposits and unit trusts instead of securities. Fixed deposits are generally uncompetitive and I can get a better risk free return via cpf. Their unit trusts have a high expense ratio and low expected returns, which makes it uncompelling. There is a slight gap between Kay hian and the bank side, and for instruments I have to approach Kay Hian to know more about it.

Comments

Post a Comment