Discount brokers and Payment For Order Flow

**Disclosure : This author currently has no stake in the mentioned companies (Robin Hood, Virtu Financial, UP Fintech Holdings, Interactive Brokers) as of this time. This is merely an analytical piece and the author may or may not initiate stakes in the near future. **

Thoughts about Discount brokers and the market impact

Payment for order flow are a recent disrupt-or to the business models of the brokerage space in the United States and Singapore. In the United States, new entrants like Webull and Robin hood led to huge reductions in the trading commissions of traditional broker-dealers such as Charles Schwab, Merrill Lynch, TDA etc. There are also major consolidations and mergers between the retail brokerages as they seek to consolidate operations to achieve economics of scale and cost savings, as they fend against the new entrants .

This leading indicator is a worrying sign on the trading and brokerage industry in Singapore. Despite recording record revenue due to the heightened market volatility, I am not so sure if the moat of the traditional brokers / banks remain intact and hesitated to invest in them despite the impressive near term quantitative metrics. I was worried that the long term revenue trends of trading and brokerages commissions will be permanently impaired, and there might be a wave of consolidations or shifting of revenue streams to the PFOF model.

Traditional brokers and the new Payment for Order Flow

Payment for order Flow is not a novel concept and is pioneered by Bernie Madoff (The guy whom created the largest ponzi scheme to date). In the traditional broker-dealer model, brokers can be self clearing whereby they have a direct linkage to the country's exchange, and execute the trade through their registered legal entity in the exchange . Alternatively, to avoid unnecessary manpower, IT infrastructure and expensive clearing licenses in the various countries, global brokers may appoint a third party dealer / local clearer which will execute the trade in the exchange on behalf of the broker.

The Payment for Order Flow is an expansion to the outsourced clearing agent. Certain hedge funds have registered local clearing licenses with the exchanges to execute trades. Instead of having a direct relationship with the various retail clients, they act as an wholesale dealer and buy feeds from various brokers / traditional banks and execute the trades. Some of the trades may not flow into the market and can be executed within the hedge fund's books, and that is a black box to most outsiders.

The hedge funds usually aggressively invest in capex (planting straight line optical fiberglass cables to shave nanoseconds off trade latency), technology and algorithms, and build up infrastructure that is designed to execute colossal amounts of trade with limited humans input. These funds may earn profits off through the market maker model (bid-offer spreads within nanoseconds via high frequency trading), or adopt a proprietary trading model, whereby they trade against the retail traders en-masse and use their superior information against the unsophisticated newly minted traders.

The case for Robin hood - Virtu Financial

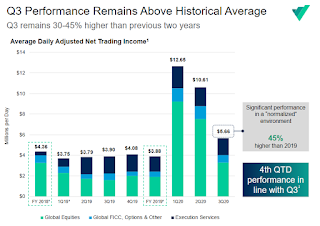

Free trades, free stocks, and gamified trading is a virally popular model in the US that has captured the headlines as of late. A lot of retail investors can tout on its merits (free trading, fun to use) and flaws (outages during peak volatility, shortened holding periods) way better than me. What I am more interested is how the trade execution party makes money. After all, if they are paying so much fees to buy trade execution rights from Robin hood, they must be using the information to make money so that they can reward their shareholders. Due to the general opaqueness of the hedge funds that are dealing with Robin hood, the only public-ally available information I can find is from Virtu-Financial whom provided some insight on how they make money.

What is interesting is that the Robin-hood feeds are termed as <retail assets> which are immensely profitable to this execution party. There is little disclosure about the actual line of business that is generating this stream of income. Cross checking with historical performance, Virtu Financial seem to be a cyclical business dependent on making money in bouts of market volatility and this might be just a temporary phase. Additionally, the landscape of exchanges are fragmented in the US market whereby even the ICE has no absolute dominance. I might study this macro-trend more in detail to see it this is a worthy idea in my portfolio.

The case for Tiger Brokers - Interactive Brokers

Tiger broker is a broker that has been aggressively marketing itself through local bloggers and investment information websites as of late. Tiger Brokers is also a listed company (Up-Financial) in the United states, which appears to use Interactive Brokers as a key local clearing agent. Similar to Robin hood, it is a pure middleman business that focuses on building the client relationships with the retail traders, and route the trades to be executed by Interactive brokers and other clearers.

Although the financials, legal risks, and operations history is not

that

great, the lure of free trades and gift stocks is certainly attractive

to average retail investors. From a cost-benefit perspective, the

savings from commission free trading can largely outweigh the bid-offer

spread that PFOF is taking, especially if the trades are of small sums.

The VIE structure is kind of concerning and I am not even sure if there

is a solid plan to protect the shareholders.

The Interactive brokers numbers seems to be very impressive from a surface level. Although I have heard of IB and noted its commission structure that is designed to incentivize heavy trading, I did not pour deeply into its growth prospects as I formerly thought it is only one of the many brokers out there. Compared to Virtu Financial, Tiger Brokers and robin hood, the operational history and financials seems to be generally more credible and robust and it is also riding on this major macro-trend of PFOF.

Conclusion

Despite the controversy on the legality of the Payment for order flow, and the questionable business practices Robin hood has adopted in an attempt to grab market share, its value proposition towards retail traders seems attractive and adoption rates are incredible. Generally, I am more averse to companies with complicated legal structures and business practices and will still be very cautious to invest with them. However, this macro-trend is likely here to stay and the days of expensive commissions is likely permanently over.

Comments

Post a Comment