Frustrations with the CFA exam

Frustrations with the CFA exam

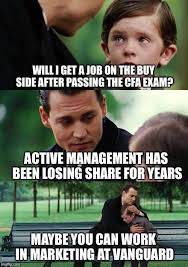

Singapore has a lackluster Equities and Bond market and the notorious reputation of a cost center. To be a credible investment analyst, I must be willing to take the leap to move to profit center areas like the emerging markets / HK / China / US / India / Middle East, network my way to front office roles and hopefully find a firm that shares a similar investment philosophy that I can grow and learn from. The market share of active investment managers has been shrinking over the years which presents a great damper to this ambition. Even passive investors like Vanguard also made an exit from HK / SG market due to business reasons. I am not so bullish about the opportunities that are available even I score well for the exam.

Retail trading VS HFTs

To my knowledge, proprietary high frequency traders / hedge funds are more interested in recruiting quants / signal processing PHDs / Machine learning programmers to scrape SEC filings for earnings beats, automated transcripts, and Natural Language processing analytics to gauge positive /negative sentiment from the latest earnings release, and machine learning programmers to execute their trading algo at a superior speed and accuracy than mere mortals. The CFA curriculum is ill equipped to learn anything noteworthy from the limited <Machine learning models> which covers breath and not depth of insight. Most likely, a pure degree is this area is required before the doors are even open in this area.

From my experience in investing in US market, institutional investors have superior investment windows in market Pre-trading hours to arbitrage their information advantage / conduct legal front running before retail investors are even allowed to execute their trades. True Alpha generators are known to guard their proprietary methods / algos with non disclosure agreements. As such, I am a skeptic on the quack remedies sold on Tiktoks/Youtube, retail blogs and investment courses promising a sure proof and automated way to generate alpha by copy trading or following a trading algorithm. Moreover, I cannot scuttlebutt as well as foreign residents in their home market, and my work commitments made it unlikely for me to keep up to date with short term news.The only conclusion I gathered is to shun away from short term trading and adopt a long term approach for portfolio management.

Factor Investing VS Modern reality

With regards to Fama French multi-factor Models <Low P/B, small cap premium, portfolio return,

which supposedly deliver value premia over time, One of the most common criticism is the use of data mining, outlier data elimination and excessive back-testing to over-fit the model. I noted the irony of Fama French adding more and more factors as their Dimensional Factor ETFs fail to beat the market. French admission that Book Value is merely a metric to reduce portfolio turnover instead of being a superior metric, Aswoth Damodaran investigation that the small cap premium has vanished from US market over the past 40 years, and French admission that a superior portfolio return is based on <Expected returns and Unexpected returns> and the unexpected returns can hugely dominate what their models are projecting.

Due to the adaptive nature of financial markets, investment methodologies that performed well in the past usually lose their consistency and effectiveness once they are made known to the public. I find it ironic that The Intelligent Investor is the Top Seller Book in Amazon, and novice investors are still attempting to blindly apply the Graham Book Value formula in The Intelligent Investor, instead of taking a critical look at the change in accounting methodologies, the intensified competitive landscape <Vanguard and Blackrock and Deep value institutional investors>, or read Graham's biography and his admission that his <Magic formula> has lost its efficacy over time.

Quant investors such as Clifford Asness of AQR capital has significant outflow in AUM due to dismal performance despite their expertise in factor investing. This make me seriously consider whether the old factors are still a reliable source of superior returns, especially with significant changes to the GAAP / IFRS accounting practices leading to GIGO.

As the CFA exams schedule took yet another setback due to the covid situation, I decide to take a break from my studies to refresh myself and recover from the burnout. Due to workplace limitations in applying for adequate study leave for my exams, additional stress levels incurred from my interactions with the ill prepared exam provider Pro-metric, and the pass rate for my mocks not yet at a satisfactory level, I decided to defer the exam to November. From a probabilistic perspective, the odds of passing of taking the exam is lower if I choose to execute it at this moment. Since I was granted this <call option> free of charge to execute the exam at November, I will exercise it and take the exam when the uncertainties are resolved and I am better prepared for it. I will commit to do my best in November for the purpose of

regret minimization. I will also be mentally prepared to write-off this project if it does not come to fruition.

Limitations of the CFA curriculum

The ironic thing about getting the CFA is that getting the charter has no correlation to superior investment performance, as measured by the number of CFA candidates vs the limited super-investors. In fact, the curriculum took specific guidelines to inform candidates that having the designation does not lead to superior performance and they cannot misguide potential investors on this. Per my scuttlebutt, the CFA should be viewed as a platform to generate networking opportunities and generate relationships to attempt to break into investment decision roles. It will not guarantee a career in this area. From my study of fund managers like Guy Spier and Bill Ackman, the key determinants affecting the clinching of the role are the geography the university is in <Huge analyzable investment market>, prestige of the school which determines the network of affluent potential investment base and premium branding, and the area of study / skill-sets the employer needs.

The ironic thing about getting the CFA is that getting the charter has no correlation to superior investment performance, as measured by the number of CFA candidates vs the limited super-investors. In fact, the curriculum took specific guidelines to inform candidates that having the designation does not lead to superior performance and they cannot misguide potential investors on this. Per my scuttlebutt, the CFA should be viewed as a platform to generate networking opportunities and generate relationships to attempt to break into investment decision roles. It will not guarantee a career in this area. From my study of fund managers like Guy Spier and Bill Ackman, the key determinants affecting the clinching of the role are the geography the university is in <Huge analyzable investment market>, prestige of the school which determines the network of affluent potential investment base and premium branding, and the area of study / skill-sets the employer needs.

Singapore has a lackluster Equities and Bond market and the notorious reputation of a cost center. To be a credible investment analyst, I must be willing to take the leap to move to profit center areas like the emerging markets / HK / China / US / India / Middle East, network my way to front office roles and hopefully find a firm that shares a similar investment philosophy that I can grow and learn from. The market share of active investment managers has been shrinking over the years which presents a great damper to this ambition. Even passive investors like Vanguard also made an exit from HK / SG market due to business reasons. I am not so bullish about the opportunities that are available even I score well for the exam.

This might be the best case scenario that I end up with

Retail trading VS HFTs

To my knowledge, proprietary high frequency traders / hedge funds are more interested in recruiting quants / signal processing PHDs / Machine learning programmers to scrape SEC filings for earnings beats, automated transcripts, and Natural Language processing analytics to gauge positive /negative sentiment from the latest earnings release, and machine learning programmers to execute their trading algo at a superior speed and accuracy than mere mortals. The CFA curriculum is ill equipped to learn anything noteworthy from the limited <Machine learning models> which covers breath and not depth of insight. Most likely, a pure degree is this area is required before the doors are even open in this area.

From my experience in investing in US market, institutional investors have superior investment windows in market Pre-trading hours to arbitrage their information advantage / conduct legal front running before retail investors are even allowed to execute their trades. True Alpha generators are known to guard their proprietary methods / algos with non disclosure agreements. As such, I am a skeptic on the quack remedies sold on Tiktoks/Youtube, retail blogs and investment courses promising a sure proof and automated way to generate alpha by copy trading or following a trading algorithm. Moreover, I cannot scuttlebutt as well as foreign residents in their home market, and my work commitments made it unlikely for me to keep up to date with short term news.The only conclusion I gathered is to shun away from short term trading and adopt a long term approach for portfolio management.

Factor Investing VS Modern reality

With regards to Fama French multi-factor Models <Low P/B, small cap premium, portfolio return,

which supposedly deliver value premia over time, One of the most common criticism is the use of data mining, outlier data elimination and excessive back-testing to over-fit the model. I noted the irony of Fama French adding more and more factors as their Dimensional Factor ETFs fail to beat the market. French admission that Book Value is merely a metric to reduce portfolio turnover instead of being a superior metric, Aswoth Damodaran investigation that the small cap premium has vanished from US market over the past 40 years, and French admission that a superior portfolio return is based on <Expected returns and Unexpected returns> and the unexpected returns can hugely dominate what their models are projecting.

Due to the adaptive nature of financial markets, investment methodologies that performed well in the past usually lose their consistency and effectiveness once they are made known to the public. I find it ironic that The Intelligent Investor is the Top Seller Book in Amazon, and novice investors are still attempting to blindly apply the Graham Book Value formula in The Intelligent Investor, instead of taking a critical look at the change in accounting methodologies, the intensified competitive landscape <Vanguard and Blackrock and Deep value institutional investors>, or read Graham's biography and his admission that his <Magic formula> has lost its efficacy over time.

Quant investors such as Clifford Asness of AQR capital has significant outflow in AUM due to dismal performance despite their expertise in factor investing. This make me seriously consider whether the old factors are still a reliable source of superior returns, especially with significant changes to the GAAP / IFRS accounting practices leading to GIGO.

Fundamental Analysis

My current portfolio is a hybrid of market indexes exposure along with active stock picking via Fundamental analysis. Thankfully, the CFA is focused in this area. However, I question the need for rote memorization of legacy rarely used or arcane formulas, when a practitioner investor will have an excel model with updated formulas in place to replicate this function. There is the use of garbage methods like Bloomberg adjusted Beta designed to normalize individual betas towards 1. Aswoth Damodaran conducted a call to Bloomberg to investigate this methodology only to learn that it is a legacy process that no one in Bloomberg even knows why it existed. Personally, I rather learn winning methods from fund managers that are still in practice and beating the market, than some irrelevant CFA academic whom try to monetize the exam by making the pass rates exclusionary rather than educative.

Conclusion

My current portfolio is a hybrid of market indexes exposure along with active stock picking via Fundamental analysis. Thankfully, the CFA is focused in this area. However, I question the need for rote memorization of legacy rarely used or arcane formulas, when a practitioner investor will have an excel model with updated formulas in place to replicate this function. There is the use of garbage methods like Bloomberg adjusted Beta designed to normalize individual betas towards 1. Aswoth Damodaran conducted a call to Bloomberg to investigate this methodology only to learn that it is a legacy process that no one in Bloomberg even knows why it existed. Personally, I rather learn winning methods from fund managers that are still in practice and beating the market, than some irrelevant CFA academic whom try to monetize the exam by making the pass rates exclusionary rather than educative.

Conclusion

My frustration and misery towards the exam is nothing compared to the human suffering around the world. With the Mutant covid virus ravaging India Indonesia and Malaysia region resulting in countless deaths, the retail store-holders whom are under financial distress from the Singapore circuit breaker, and the front line medical staff risking their lives to help the patients to recover, my misery is probably nothing compared to others whom has much more at stake.

On a positive note, I manage to pick up some discounted equities on the cheap. I have acclimatized to the fact that I cannot pick the bottom with my lousy market timing, and feel less disturbed as prices continue to trail lower regardless of earnings beat. I shall try to keep myself motivated for the months ahead.

On a positive note, I manage to pick up some discounted equities on the cheap. I have acclimatized to the fact that I cannot pick the bottom with my lousy market timing, and feel less disturbed as prices continue to trail lower regardless of earnings beat. I shall try to keep myself motivated for the months ahead.

Comments

Post a Comment