Double TwoBaggers

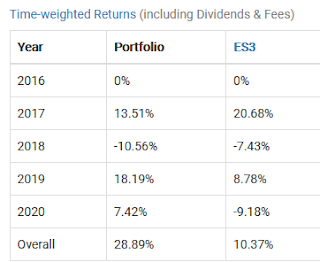

Double TwoBaggers As the HK/CN, US and SG markets continue their path to recovery, I have passed the hurdle of scoring my first 2baggers. These stocks are initially chosen based on high quality business at a margin of safety rather than quantitatively cheap stocks, and the revenue / profit growth is accompanied by multiples expansion leading to such a result. Fortunately, these stocks are among the larger positions in my portfolio and contributed significantly to my net worth. I do not think my results are exceptional given the heightened market sentiment and valuation among different asset classes. Traders / Investors in SPACS / cryptos and IPO stocks probably get their first multibagger in hours / days instead of years. In fact, there are widespread concerns about bubble-like valuations among investors / traders I greatly respect, whom are more experienced in the markets than me. However, the market can stay irrational indefinitely and I believe my attempts to time the market wi...