The intelligent investor

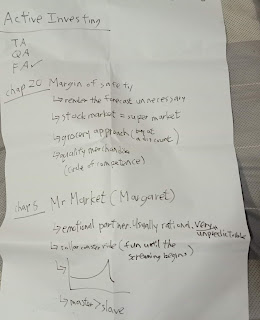

The intelligent investor is one of the first books I have read on investing theory, outside of conventional EMH finance academia. This book is just as captivating the last time I revisited this book as compared to the first time. The ideas behind it are timeless and relevant regardless of bear markets and bull markets. The Net Net approach is one of the first screens I adopted for SG market (only chews made the cut). After reading Ben Graham biography and quotes at the later part of his life and cross referencing with other sources, I realized the limitations of net net approach to investing, like the existence of accounting fraud and need for wide diversification, value traps and need for active efforts in liquidation especially for cash burning companies. The improvement of technology in screening and retrieval tools as well as more widespread investing knowledge made the opportunities of strict formula based value investing increasingly exhausted. Peter Lynch, Joel Greenblatt a