The intelligent investor

The intelligent investor is one of the first books I have read on investing theory, outside of conventional EMH finance academia. This book is just as captivating the last time I revisited this book as compared to the first time. The ideas behind it are timeless and relevant regardless of bear markets and bull markets.

The Net Net approach is one of the first screens I adopted for SG market (only chews made the cut). After reading Ben Graham biography and quotes at the later part of his life and cross referencing with other sources, I realized the limitations of net net approach to investing, like the existence of accounting fraud and need for wide diversification, value traps and need for active efforts in liquidation especially for cash burning companies. The improvement of technology in screening and retrieval tools as well as more widespread investing knowledge made the opportunities of strict formula based value investing increasingly exhausted. Peter Lynch, Joel Greenblatt and Templeton noticeably has incorporated value and growth concepts with contrarian viewpoints and are successful in their own right. As institutional investors have battalions of PHD and analysts following and keeping tabs on the large cap / popular stocks, it is necessary to explore less covered / smaller cap companies to achieve market beating results.

Nonetheless, the qualitative lessons in chapter 8 and 20 are so compelling that I crafted a Toastmasters speech based on them, and decided to add some personal commentary in my blog-post.

The Intelligent Investor

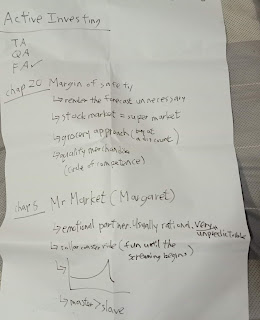

Chapter 20 Margin of safety

The purpose of margin of safety is to render the forecast unnecessary.

Stock market like a super market. Adopt a Grocery approach to investing and buy at a discount. The larger the discount the better.

Learn how to identify goods that can generate superior cash flow as well as deploy cash flow to achieve incremental returns over long periods of time. Superior goods can only be identified via operating within your circle of competence and widening it over time.

Chapter 8 Mr Market / Margaret

Fit your personality and temperament to your investment strategy and portfolio composition

Treat Mr market / Margaret as your usually rational but sometimes recklessly emotional partner.

The Intelligent Investor

Chapter 20 Margin of safety

The purpose of margin of safety is to render the forecast unnecessary.

Stock market like a super market. Adopt a Grocery approach to investing and buy at a discount. The larger the discount the better.

Learn how to identify goods that can generate superior cash flow as well as deploy cash flow to achieve incremental returns over long periods of time. Superior goods can only be identified via operating within your circle of competence and widening it over time.

Chapter 8 Mr Market / Margaret

Fit your personality and temperament to your investment strategy and portfolio composition

Treat Mr market / Margaret as your usually rational but sometimes recklessly emotional partner.

Stock market is like a roller coaster ride. It was fun and chuckles when the market makes the slow ascent up. It is when the roller coaster comes crashing down. That is when the screaming begins.

Make yourself the master and not the slave when your emotional partners is throwing emotional tantrums (downturns) or promising you the sky when it is unfeasible to happen. Buy / sell at the point of maximum pessimism / optimism.

General afterthoughts about the market condition

The recent IPO of money losing technology companies is another red flag on the unwarranted optimism of the market. Despite my limited understanding of technology companies, to my knowledge lumping up all technology companies as a single winning thesis is a very dangerous game to play. Valuation fundamentals, margin of safety, and unwarranted optimism are conveniently overlooked as mythical unicorns enter the stage.

Business model of the various technology companies are like heaven and Earth.

Amazon (transactional driven cash flow )

Microsoft (Lumpy software sales, transitioning to SAAS cash flow)

Facebook, Google (marketing revenue based cash flow)

Tencent (Gaming revenue via micro transactions, exploring commercial SAAS)

Netflix (Subscription based SAAS model)

Often, novice investors extrapolate the incredible success of one company and extrapolate it to finding the next Facebook, where in actuality a true game-breaker is most likely to exist in a blue unexplored market rather than the behemoths the existing tech giants are entrenched in. There are really few superior business that can grow while generating high returns while requiring less funds via economics of scale.

Opo /Mobike despite harassing big data, has faced immense difficulties in scaling up businesses while reducing expenses, and have to incur higher capex grow further. There is no economics of scale as it grows further.

Similarly Lyft grab and uber and their food delivery counterparts (GrabEats, UberEats, MeiTuan DianPing) although utilizing a platform like structure, incurs a high amount of (price -war subsidy driven ) heavy expenditure driven model and have not been profitable since inception. Most likely, an entire shift in business strategy and operating model must materialize in order for them to achieve profitability, which is untested and unproven. Alternatively, an oligopoly in tacit agreement of appropriate price setting might surface as the market reaches equilibrium, but when and how it may happen without resistance from regulators (antitrust violations) and consumers / drivers is still largely unknown.

As I continue to increase my war chest and strive to only swing at the right pitches, I might actually try to blog about the VBA codes and theory I have been learning for the past months. I shall try to remain disciplined and make my investing process sound in accordance to the heightened risks and pricing of the market. I shall strive to keep blogging on a monthly basis until interesting news / opportunities surface.

Comments

Post a Comment