A tale of 2 exchanges

A tale of 2 exchanges

The

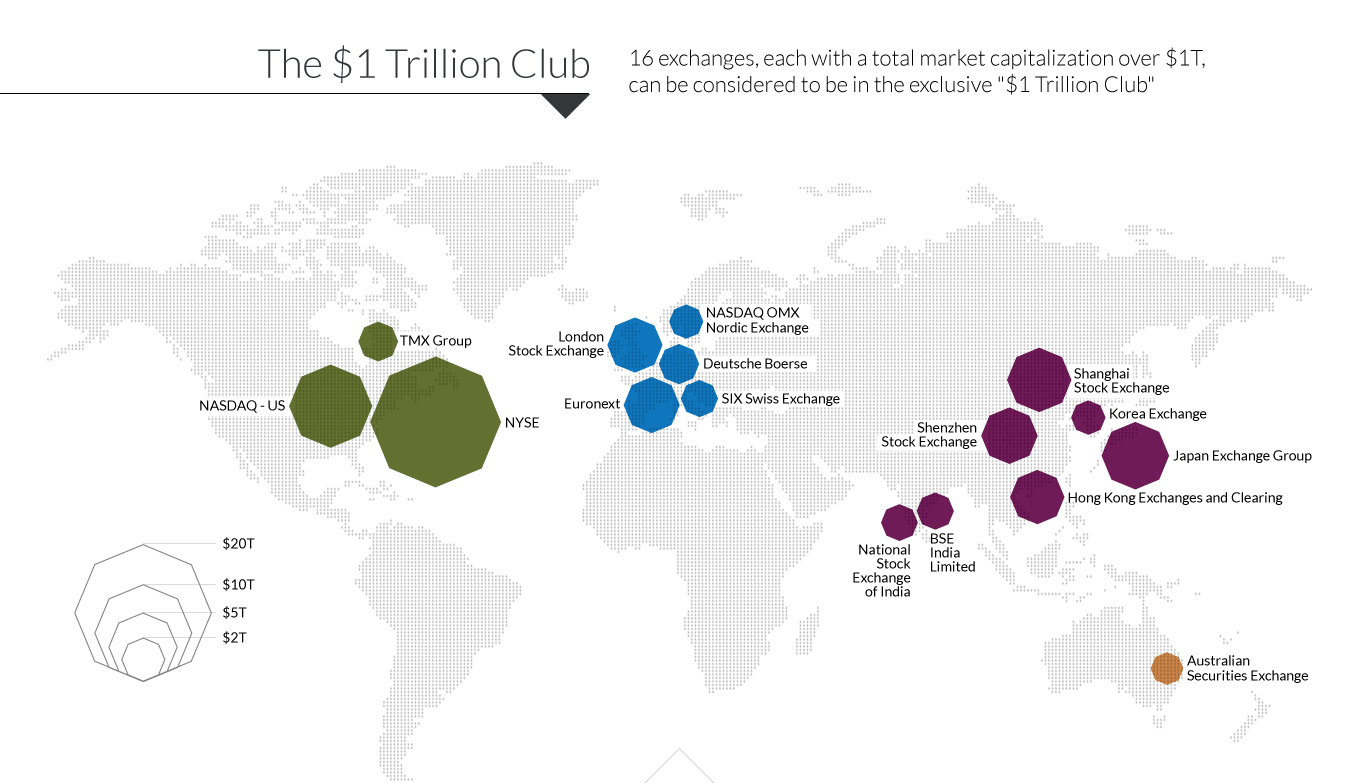

economics of stock exchanges vary from country to country and depend on the trading volume, investor perception about future prospects, ease and cost of transactions (Capital Gain Tax, Dividend Tax, Stamp duty, Capital Controls), developed market infrastructure and established market practices etc. Countries like Sri Lanka, Mauritius, Philippines, Bangladesh will have noticeably smaller trading volume than the major exchanges above.

Not all exchanges are created equal. My interest in stock exchanges stemmed from UnN post about the Intercontinental Exchange. That led me to do some bedside reading on Chicago Mercantile Exchange and eventually led me to HKEX and SGX, whereby I initiated a large and mid conviction position respectively. They are largely similar in their key risks and prospects although the economics of these exchanges are vastly different.

As an investor in SGX and HKEX, I am impressed by the high profit margins and balance sheet strength of these stocks exchanges in general. Stock exchanges noticeably has considerable good will in their balance sheets and have to resort to acquisitions to grow their revenue stream. HKEX has a particular strong tailwind. brought about by the Stock and bond connect and act as the ERP gateway between China and the rest of the world. SGX by comparison has to slog it out the hard way and fight for listing opportunities and brand itself as the gateway between the East and the West to increase trading volume.

Recently, the growth story of SGX derivative business is threatened by HKEX potential entry to the China A50 index futures. The traditional clearing and listing business is lackluster in SGX and the recent corporate scandals are not helping to inspire investors' confidence in this area. This has brought a recent share price correction to SGX and I am relooking at SGX to determine if there is unwarrented market mispricing.

Investing in SGX involves the belief in the thesis below. Slow Grower with gradual capital gain in the long term. Dividend play with potential further dividend upside.

1) The lucrative and moat-like Derivative business will continue to grow and HKEX may not be able to claw business effectively as SGX maintains first mover advantage. Margins might suffer slightly but not detrimental.

2) China A 50 constitutes a large portion of the derivative business growth and the investor have to figure out whether the concentration risk is significant enough to negatively affect the business if HKEX enters the arena. With all said and done, additional contracts provider may / may not not be detrimental to the SGX bottom line and this warrants further analysis.

Not all exchanges are created equal. My interest in stock exchanges stemmed from UnN post about the Intercontinental Exchange. That led me to do some bedside reading on Chicago Mercantile Exchange and eventually led me to HKEX and SGX, whereby I initiated a large and mid conviction position respectively. They are largely similar in their key risks and prospects although the economics of these exchanges are vastly different.

As an investor in SGX and HKEX, I am impressed by the high profit margins and balance sheet strength of these stocks exchanges in general. Stock exchanges noticeably has considerable good will in their balance sheets and have to resort to acquisitions to grow their revenue stream. HKEX has a particular strong tailwind. brought about by the Stock and bond connect and act as the ERP gateway between China and the rest of the world. SGX by comparison has to slog it out the hard way and fight for listing opportunities and brand itself as the gateway between the East and the West to increase trading volume.

Recently, the growth story of SGX derivative business is threatened by HKEX potential entry to the China A50 index futures. The traditional clearing and listing business is lackluster in SGX and the recent corporate scandals are not helping to inspire investors' confidence in this area. This has brought a recent share price correction to SGX and I am relooking at SGX to determine if there is unwarrented market mispricing.

Investing in SGX involves the belief in the thesis below. Slow Grower with gradual capital gain in the long term. Dividend play with potential further dividend upside.

1) The lucrative and moat-like Derivative business will continue to grow and HKEX may not be able to claw business effectively as SGX maintains first mover advantage. Margins might suffer slightly but not detrimental.

2) China A 50 constitutes a large portion of the derivative business growth and the investor have to figure out whether the concentration risk is significant enough to negatively affect the business if HKEX enters the arena. With all said and done, additional contracts provider may / may not not be detrimental to the SGX bottom line and this warrants further analysis.

3) Derivative business is set to grow as businesses become more internationalized. To manage cross country, FX risks as well as circumvent legislation / currency control, the trading of derivatives may become more widespread. Nonetheless, regulatory risk is particular strong for regulated exchanges as well as derivatives. What provides the company a moat like quality could easily become a prison if the government policies go downhill.

4) The lackluster investor sentiment in SGX may be overdone Eventually as China loses its shimmer, Investors looking into the ASEAN growth story may re-channel back their funds to Singapore market eventually. Market practices of India / Philippines is not yet so established and the launch of ASEAN ETFs may spawn investor interest whom using them as a proxy to Asia.

5) The bond market is massive but underdeveloped in the Singapore sector, with huge principals that are mainly traded by institutional and not easily accessible by retail investors. There is a notably strong interest in dividend investing which may open up retail interest on debt investing.

6) A change in dividend policy from percentage earnings, to a fixed dividend policy is an implicit assurance from managers that they can support the dividend payout in the long run (well supported by low debt and strong FCF and OCF). Management is signalling to investors that SGX is a bond like dividend company warranting a DDM valuation. This might invite investors to have assurance that they can have a strong haven to park their funds while enjoying stable cash flow.

Caveats

1) Growth story in the debt hub may be heavily mired by the Hyflux disaster. The original outlook of SGX BondPro to automate trading of fixed income is a good initiative to improve market efficiency and liquidity. However, the recent Hyflux corporate disaster could have detrimental effects on negative perception on Investor protection and corporate transparency, as well as the role / responsibilities of the various gatekeepers (DBS Bookmakers, Auditors, Directors).

2) There is limitations to the growth of the Singapore traditional trading and clearing businesses. SGX is not a strong dividend player compare to REITS or Singtel. Instead of returning excess funds to shareholders, it pursues growth by retaining cash to make ac-creative acquisitionsthat can bring about future upside.

Goodwill inflation will be considerable (with potential write-offs) and much depends on managers to make good acquisition decisions and not diwosify.

5) The bond market is massive but underdeveloped in the Singapore sector, with huge principals that are mainly traded by institutional and not easily accessible by retail investors. There is a notably strong interest in dividend investing which may open up retail interest on debt investing.

6) A change in dividend policy from percentage earnings, to a fixed dividend policy is an implicit assurance from managers that they can support the dividend payout in the long run (well supported by low debt and strong FCF and OCF). Management is signalling to investors that SGX is a bond like dividend company warranting a DDM valuation. This might invite investors to have assurance that they can have a strong haven to park their funds while enjoying stable cash flow.

Caveats

1) Growth story in the debt hub may be heavily mired by the Hyflux disaster. The original outlook of SGX BondPro to automate trading of fixed income is a good initiative to improve market efficiency and liquidity. However, the recent Hyflux corporate disaster could have detrimental effects on negative perception on Investor protection and corporate transparency, as well as the role / responsibilities of the various gatekeepers (DBS Bookmakers, Auditors, Directors).

2) There is limitations to the growth of the Singapore traditional trading and clearing businesses. SGX is not a strong dividend player compare to REITS or Singtel. Instead of returning excess funds to shareholders, it pursues growth by retaining cash to make ac-creative acquisitionsthat can bring about future upside.

Goodwill inflation will be considerable (with potential write-offs) and much depends on managers to make good acquisition decisions and not diwosify.

Conclusion

Overall, I am still undecided on the outlook of SGX and is merely penning down my thoughts as I go through the annual report. The story of HKEX with a global-chinese hinterland is much more positive compared to the challenging circumstances of SGX today. I will need to assess if I have additional insight to the SGX business before I consider initiating further positions or just stay in cash.

Links

https://en.wikipedia.org/wiki/List_of_stock_exchanges

https://asia.nikkei.com/Business/Markets/Nikkei-Markets/Singapore-Exchange-hurt-by-HKEX-s-China-derivatives-move

http://www.sgx.com/wps/wcm/connect/4d82a06b-9932-46f8-9cf8-9efe682af7ae/SGX+vs+HKEX+-+The+Edge.pdf?MOD=AJPERES

https://www.globalcapital.com/article/b179r6z8nkf1p8/hkex-is-unlikely-to-lose-ground-to-sgx

https://www.youtube.com/watch?v=Nf3qDIdO0iM

Comments

Post a Comment