VICOM

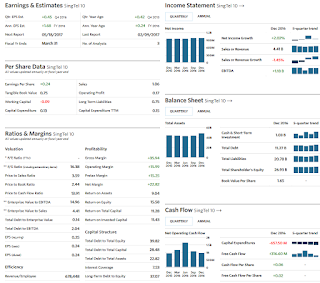

Use external data from yahoo finance, Wall Street Journal, Morningstar, POEMS http://www.bytesizedinvestments.com/why-did-vicoms-2nd-quarters-net-profit-dropped/ http://www.bytesizedinvestments.com/a-deeper-dive-into-vicoms-fundamentals/ www.bytesizedinvestments.com/tag/vicom/ https://www.valuebuddies.com/thread-240-page-44.html http://www.nusinvest.com/wp-content/uploads/2015/02/VICOM-Equity-Research-Report-010215.pdf http://www.apenquotes.com/vicom-crack-in-paradise/ http://sgyounginvestor.blogspot.sg/search?updated-max=2013-07-01T20:10:00%2B08:00 Hold off buying, Wait for events to happen if price shock. Slightly overvalued based on most fundamentals but undervalued based on DDM and 3 year price history. 1) Business Outlook Lines of business + Prospects 2) SWOT P E S T VICOM 2 main business segments. It has a vehicle inspection company and, SETSCO, its non-vehicle inspection and compliance company. Vehicle inspection ...