VICOM

Use external data from yahoo finance, Wall Street Journal, Morningstar, POEMS

http://www.bytesizedinvestments.com/why-did-vicoms-2nd-quarters-net-profit-dropped/

http://www.bytesizedinvestments.com/a-deeper-dive-into-vicoms-fundamentals/

www.bytesizedinvestments.com/tag/vicom/

https://www.valuebuddies.com/thread-240-page-44.html

http://www.nusinvest.com/wp-content/uploads/2015/02/VICOM-Equity-Research-Report-010215.pdf

http://www.apenquotes.com/vicom-crack-in-paradise/

http://sgyounginvestor.blogspot.sg/search?updated-max=2013-07-01T20:10:00%2B08:00

Hold off buying, Wait for events to happen if price shock. Slightly overvalued based on most fundamentals but undervalued based on DDM and 3 year price history.

1) Business Outlook

Lines of business + Prospects

2) SWOT

P

E

S

T

VICOM 2 main business segments.

It has a vehicle inspection company and, SETSCO, its non-vehicle inspection and compliance company.

Vehicle inspection

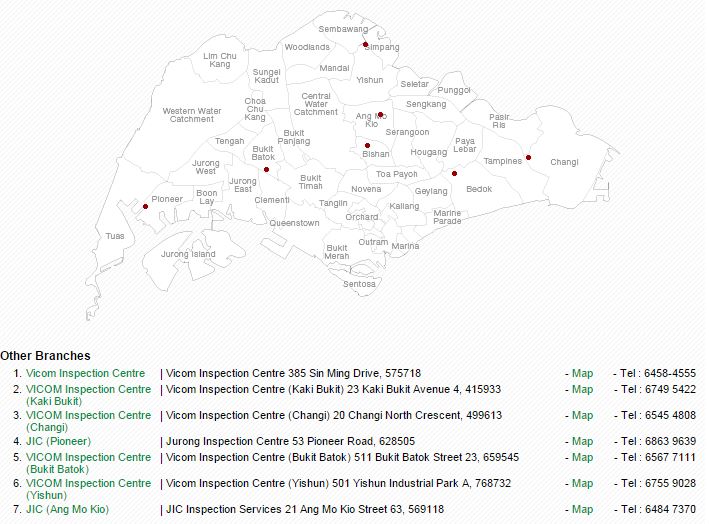

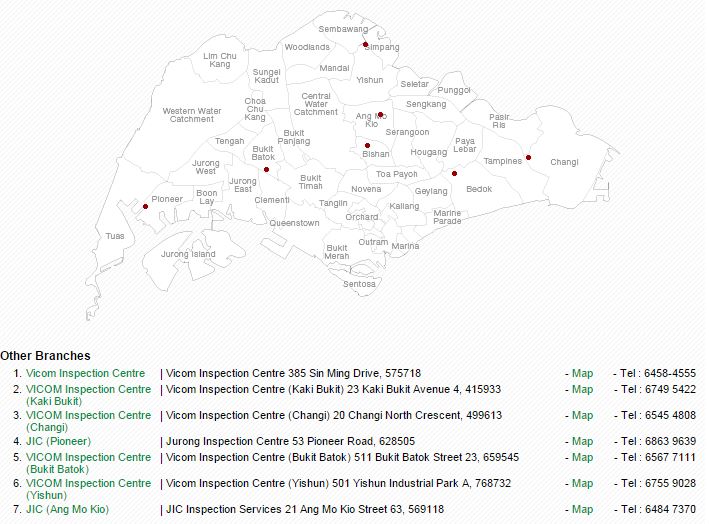

Vehicle inspection is a government mandated necessity for vehicle owners and thus very transactional. Most customers have no loyalty or preferences on vehicle inspection companies and would go to the nearest or most convenient inspection centre. As Vicom owns 7 of 9 inspection centres in Singapore (see map below), it has the largest catchment area, thus owning 70% of the market share.

vehicle inspection operations are regulated, a lot of information can not only be found from Vicom, but also from other references such as Land Transport Authority (LTA), Comfortdelgro Corporation Limited (CD) and etc.

Notice the correlation of Vicom’s earnings to the number of vehicles that require inspection. The earnings rise and fall in tandem with the vehicles inspected. Unless there’s a huge game changer from SETSCO, we believe that Vicom’s earnings are relatively pegged to the vehicles inspected.

Vicom is currently hit on two major

fronts. Its vehicle testing and inspection segment experiencing a

downturn due to a high number of vehicle deregistration from 2015

onwards. I have previously written about it here.

Its non-vehicle testing and inspection segment, SETSCO, is also experiencing headwinds as the industries they serve are experiencing a continued slowdown, especially in the petrochemical, oil and gas sector.

In 2015, Vicom managed to cut more than 15% of their expenses, from material and consumables to repair and maintenance, utilities and communications segments. However, comparing that with FY14, this cut could possibly be one-off.

Vicom is simply cash-rich. Looking at its balance sheet, you will find that cash and cash equivalent (CCE) make up 56.6% of the company’s balance sheet! To sweeten the deal, it does not have any debt in its balance sheet. Its total liabilities are only S$29.4 million; the cash it holds could easily cover the liabilities 3 times over!

Vicom Limited’s business model is pretty boring with little to no drama. This makes Vicom very predictable. Why is this so?

Due to the meteoric rise in COE, the cost of replacing a car became very high. As such, people are sticking with their existing cars to maximise their COE dollars. This resulted in the decrease of scrapped cars under 10 years old, translating to more cars requiring inspection. New cars registered will take 3 years before being considered into the inspection pool. By knowing the number of cars registered in 2015, we should be able to estimate the number of cars inspected from now till 2018 with much confidence.

Porter 5 Forces (Pricing Power)(Franchising)

Threat of New entrants

Vehicle Inspection - NIL

Non Vehicle inspection - Very High Threat, High Likelihood

Bargaining power of suppliers

Vehicle Inspection - Unknown

Non Vehicle inspection - Unknown

Bargaining power of Buyer

Vehicle Inspection - Very Weak, 70% Market Share, Oligopolistic industry, Great Pricing power

Non Vehicle inspection - Very Strong, many competitors offering services

Threat of substitutes in products and Services

Vehicle Inspection - NIL, essential services to be done every 6 months, mandated by law

Non Vehicle inspection - Unknown

Rivalry among existing competition (SGS SA and Bureau Veritas)

Vehicle Inspection - Unknown

Non Vehicle inspection - Unknown

Organisational Life Cycle

What type of stock it is and what I am looking out for. - Mature Company, Stalwart and Dividend

Growth rate - 1.09% based on FY2012to2016 Geometric Mean

Beta - 0.33

CAPM (required rate of Return)( Rename Beta, Obtain adjusted Beta, Use STI ETF as Rm,

- 3.6892

Company Geometric Return - 1.09% based on FY2012to2016 Geometric Mean

2) Financial Ratio Health Analysis with peers

Profitability - Great

Liquidity/ Leverage - Incredible, Not Debt at all

Cash Ratio = (Cash + cash equivalents) / Current liability

Current Ratio = (Current Asset / Current Liability)

Debt ratio = (Total Liability / Total Asset)

Quick Ratio

Operating cash flow - increasing steadily, low fluctuation

Investing cash flow - always negative, better over the years

Financing cash flow - always negative, spike in 2014 and 2015

Performance - Mixed

Return on Asset - ROA declining over the years

Sales Turnover - ROE declining over the years

Earnings Per Share - Earnings per share improving gradually

Return on Investment

Tax Retention Rate (tax efficiency, higher better) = (EBIT - tax exp) /EBIT

Interest Expense Rate (lower better) = int exp / Totalasset

Return on Equity - 19.02 (WSJ), Great Profit Margin, Poor Asset Turnover, Great Financial Leverage

Dupont ROE analysis - Profit Margin x Asset Turnover x Financial Leverage

Profit Margin - 27.83

Total Asset Turnover - 0.57

Financial Leverage - 1.19900902093538 (GoalSeek)

ROE = Net Income/Net Sales x Net Sales/Total Asset x Total Asset x Common Equity

3) Valuation Models

1) DDM = V=D(1+g)/(Re-g)

i) Requires consistent Dividend policy and payout

ii) Gorgon constant Growth model

iii) Good to value mature companies with stable growth, profit, dividend growth

iv) Not good to value companies prone to macroeconomic and cyclical factors, large fluctuation in profits and dividend growth

2) FCFE

Net Profit After tax

- (CAPEX-dep exp)(1-debt ratio)

- (Change in working capital)(1-debt ratio)

= FCFE

i) Estimate of Equity Capital Usage, Determine whether Dividend and stock repurchases is paid via free cash flow or other financing methods. If FCFE > Dividend payment and cost to buy back shares, Company is using debt of existing capital for share buyback, essentially propping up share price.

ii) Good to value growth companies and start-ups with no dividends.

iii) Cannot value companies with drastic change in working capital.

iv) focus on net profit after tax, ignore cash flow issues such as investments in fixed assets, net borrowings and working capital.

3) Price Earnings Ratio = Market P / Earnings per share -18.26

i) Must have consistent earnings and growth, take average of 4 quarters

ii) Use to compare companies within same industry, Low P/E undervalued and great performance, High P/e investors expect high earnings growth

iii) Essential to do Dupont analysis, Can be manipulated by increasing leverage

iii) Not good to Value start-ups, loss making, unstable profits or growth focused company.

iv) Not good to value economies with high inflation, insufficient discounting factors time value of money

4) Price per book value = Market P / Book Value - 3.432

i) Low P / BV = undervalued or fundamental weakness, how much is company worth after liquidating everything

ii) Only use to compare with companies in same industry, with positive book value, short run negative earnings

iii) Not Good for Companies focusing on Branding and Goodwill (BAML), change in accounting methodology, Comparison across countries, Change in technology, change in asset prices (depreciation, amortisation, appreciation), inflation or present market of assets, improved products and services.

iv) Not good for technology companies (No fixed assets) and consistent loss making companies.

5) Price Sales ratio = Market P / Sales per share - 5.088

i) Less Prone to Accounting manipulations, Low P/S undervalued or not profitable

ii) Only compare between close competitors, when company no P/E ratio or no earnings.

iii) Good to value start-ups, growth companies, unprofitable companies at mature phase

iv) Not good as it ignores expenses and liabilities

Compare with Mkt P on fixed date, Over/Under Valued, Buy / sell

DDM

FCFE

P/E

P/B

P/S

4) Buy / Sell Decision

1) Fundamental Target Price Range - Heavily Mixed Signals. Vicom is overvalued even when trading near its 3 year low. If Vicom can sustain its dividend payout it is severely undervalued. All Other ratios suggests Vicom is Overvalued.

2) Consider Support Resistance Lines

3) Consider Technical Analysis input by POEMS

4)Consider Analyst consensus opinion, Favouring stocks with minimal analyst coverage

5) Buffet Valuation Checklist

Business Tenets

1) Is business simple and understandable? (choose companies within your circle of competence, not the size of the circle but rather how defined are its parameters)

2) Does Business have consistent operating history? (Operating performance, Cash Flow especially for SME)

3) Does business have favourable Long term Prospects? (American Steel industries decline, avoid commodities, Porter's 5 forces - choose franchises that products are needed and desired, with no close substitutes, unregulated, quality, weak competitors. branding / quality allowing company to retain market and pricing power to pass on costs to consumers)

Management Tenets

4) Is management rational and track record of competence? (SMRT clowns)

5) Does business have strong track record and consistent good leadership and management (management changes, adopting of technology, recognition of fundamental changes in economy)

6) Does management resist institutional imperative? (Manager Mismanagement and inertia to change)

Financial Tenets

7) What is the ROE? (Revenue, Expenses, Cash Flow, Labour relations, pricing flexibility, capital allocation needs). Look out for cash flow, indebtness and changes in interest rates

8) What is the company's owner earnings?

9) What are the operating margins?

10) Has company created at least 1 dollar of market value for every dollar retained?

Value Tenets

11) What is the value of the company (Intrinsic, Book, Market). Buy a good company at an undervalued Price. Buy a very good company at a fair price as good companies are closely monitored

12) Can it be purchased as significant discount to its value? (undervalued, Very good prospects / projects)

Reflection

1) I am glad that VICOM despite being poorly covered in mainstream stockbroker analysis, has a wealth of knowledge covered by amateur investors. I owe them a lot and also learned a lot. However, actual fundamental analysis based on valuation model is really poor. I am glad I have retained my Investment Analysis Project knowledge and able to utilise them to the fullest extent.

2) I realised that with each additional analysis I conduct, I tend to get more detailed and more valuation model focused. Previously, I invest based on optimism and cyclical lows. This company is very difficult to evaluate based on outlook as the decline of the industry is certain and the fundamentals are deteriorating along with the price. I will monitor the fundamentals closely as it is a good company but doing poorly due to market outlook. I will look out for COE, government signals and Vicom Press release and buy based on events or price shocks, if available.

3) My father being knowledgable in vehicle inspection has briefed me a lot about the workings of the vehicle inspection process. I am glad to have his knowledge but I believe I might want to schedule a trip down for vehicle maintenance to see how it operates on the ground,

http://www.bytesizedinvestments.com/why-did-vicoms-2nd-quarters-net-profit-dropped/

http://www.bytesizedinvestments.com/a-deeper-dive-into-vicoms-fundamentals/

www.bytesizedinvestments.com/tag/vicom/

https://www.valuebuddies.com/thread-240-page-44.html

http://www.nusinvest.com/wp-content/uploads/2015/02/VICOM-Equity-Research-Report-010215.pdf

http://www.apenquotes.com/vicom-crack-in-paradise/

http://sgyounginvestor.blogspot.sg/search?updated-max=2013-07-01T20:10:00%2B08:00

Hold off buying, Wait for events to happen if price shock. Slightly overvalued based on most fundamentals but undervalued based on DDM and 3 year price history.

1) Business Outlook

Lines of business + Prospects

2) SWOT

P

E

S

T

VICOM 2 main business segments.

It has a vehicle inspection company and, SETSCO, its non-vehicle inspection and compliance company.

Vehicle inspection

Vehicle inspection is a government mandated necessity for vehicle owners and thus very transactional. Most customers have no loyalty or preferences on vehicle inspection companies and would go to the nearest or most convenient inspection centre. As Vicom owns 7 of 9 inspection centres in Singapore (see map below), it has the largest catchment area, thus owning 70% of the market share.

vehicle inspection operations are regulated, a lot of information can not only be found from Vicom, but also from other references such as Land Transport Authority (LTA), Comfortdelgro Corporation Limited (CD) and etc.

Non-vehicle

inspection operations (SESTCO).

As the non-vehicle inspection segment is highly fragmented and competitive, Vicom opted to report it together with its vehicle inspection operations.

As the non-vehicle inspection segment is highly fragmented and competitive, Vicom opted to report it together with its vehicle inspection operations.

- SETSCO is the sole provider of inspection services in the Pressure Vessels and Lifting Equipment category for air receiver, tank and chain block.

- SETSCO also participates in the building construction and maintenance inspection, competition is slightly lesser with around 2-3 competitors in each of its accredited inspection area. Inspection is a recurring income as under the Building Control Act, a building that is not solely used for residential purposes will need to be inspected every 5 years from the date of TOP and 10 years for residential building.

- SETSCO’s strength lies in it having the most number of accreditations in the whole range of services.

- Customer loyalty tends to be high as it may be costly and time consuming to switch between such service providers, and even more so in specialized cases that can only be delivered by a few certification companies.

Vehicle inspection

Most

owners chose to deregister their cars after the tenth year as you can

see from the chart below from the drastic drop in car population after

the tenth year. Hence, it would be normal to see a slight decrease in

revenue going ahead from 2016 to 2018 as more vehicles continue to

deregister. However, Vicom has very strong pricing power and can choose

to increase prices to offset the decrease in volume.

Notice the correlation of Vicom’s earnings to the number of vehicles that require inspection. The earnings rise and fall in tandem with the vehicles inspected. Unless there’s a huge game changer from SETSCO, we believe that Vicom’s earnings are relatively pegged to the vehicles inspected.

Its non-vehicle testing and inspection segment, SETSCO, is also experiencing headwinds as the industries they serve are experiencing a continued slowdown, especially in the petrochemical, oil and gas sector.

In 2015, Vicom managed to cut more than 15% of their expenses, from material and consumables to repair and maintenance, utilities and communications segments. However, comparing that with FY14, this cut could possibly be one-off.

Vicom is simply cash-rich. Looking at its balance sheet, you will find that cash and cash equivalent (CCE) make up 56.6% of the company’s balance sheet! To sweeten the deal, it does not have any debt in its balance sheet. Its total liabilities are only S$29.4 million; the cash it holds could easily cover the liabilities 3 times over!

Vicom Limited’s business model is pretty boring with little to no drama. This makes Vicom very predictable. Why is this so?

Recall

that the government mandates the need for biennial inspection for cars

that are 3 – 10 years old, and thereafter, every year after 10th year

(highlighted in yellow in the table below).

Due to the meteoric rise in COE, the cost of replacing a car became very high. As such, people are sticking with their existing cars to maximise their COE dollars. This resulted in the decrease of scrapped cars under 10 years old, translating to more cars requiring inspection. New cars registered will take 3 years before being considered into the inspection pool. By knowing the number of cars registered in 2015, we should be able to estimate the number of cars inspected from now till 2018 with much confidence.

And

since we observed that Vicom’s earnings rise and fall in tandem with the

vehicles inspected, and we believe we are able to estimate the

inspection numbers for the next 3 years, we deduce that Vicom’s earnings

in the next 3 years are predictable. So what are the predictions?

Number of vehicles aged 3 – 10 that

require inspection drops every year, starting from 2015 till 2018. The

biggest drop comes in the year 2016 where total cars that require

inspection drops by almost 50,000. This would drastically impact Vicom’s

earnings as lesser vehicles would be due for inspection. Furthermore,

there will be an approximate drop of 100,000 inspected from 2015 to

2018, translating to a 35% drop.

Even with a bumper crop year in 2016, we will only see a fundamental recovery after 2019.

In 2015,

about 57,000 new cars were registered. What if, like in 2015,

approximately 60,000 new cars were registered consistently after 2016?

By 2019, the number of vehicles inspected was projected to be only

around 157,000. This is still about 10% lower compared that to our

projected 2018 figure of 175,000. In fact, if the government

consistently releases 60,000 new COE, and SETSCO maintain constant, we

will never see the peak we see in 2013.

To see a recovery in 2019, new cars

registered in 2016 must be more than 80,000. This would result in

similar number of cars inspected in our 2018 projected figure. And

should new cars be consistently released at 80,000 for the next 5 years,

we would see 2013’s peak only in 2023.

we

foresee Vicom would experience some headwinds. However, the outcome

could differ should our assumptions turn out differently. For example,

we highlighted that we did not factor in a possible stellar performance

of SETSCO, or the possible increase in inspection fees. Also note that,

should more owners choose to keep their cars beyond 10 years, it would

also positively impact Vicom’s earnings.

Conclusion: The

macroeconomic view of Vicom is slightly gloomy, with headwinds from both

the government’s car-lite policies (long-term) and the higher

deregistration of vehicles compared to registration (short-term: 2-3

years). Hence a drop in net profit in the short term wouldn’t be a

surprise. However, the business is cyclical, which means that it will

pick up once the up cycle swings in. Vicom has a strong and honest

management and they are exploring all means to improve shareholder’s

returns. It is worth monitoring Vicom’s key data for the fundamental

inflection point.

PEST

PEST

No political support, Government aggressively vocal to choose public transport over private

Unlikely to grow much further in Singapore as it is a mature market.

Car registration is likely to drop. IMHO demand for vehicle ownership is price inelastic, certain businessmen and workers will still need vehicles regardless. Personal Usage vehicles will decline but commercial and work usage is unlikely to drop regardless of COE.

Due to heightening COE, and people choose to retain vehicles over Purchasing them, leading to increase in maintenance revenue

70% Market Share and Oligopolistic industry in inspections makes pricing power of VICOM strong, and bargaining of buyers Weak

Grab Comfort Uber having their price wars. Subsidiary of Comfort. Comfort is unlikely to gain much from cutting profit margins and increase cost of goods sold. Vehicle maintenance however is likely to gain from the increase in vehicles on the road, considering it has 70% of market share. Grab and Uber has mandatory inspections too???

Does management have any insight towards any concrete plan from Government?

Is Driverless cars and buses going to be a real thing? Is there any long term direction from management?

Are there any plans for business development and new businesses?

Most Likely hold on buying until management or government gives a distinct Signal.

Trading at slightly above 3 year low, Mixed Signals on Fundamental analysis due to dismal outlook on industry

Monitor COE, Oil and Gas, Government, Comfort Signals

Beta is low, not correlated with STI but correlated with COE Cycle

Car registration is likely to drop. IMHO demand for vehicle ownership is price inelastic, certain businessmen and workers will still need vehicles regardless. Personal Usage vehicles will decline but commercial and work usage is unlikely to drop regardless of COE.

Due to heightening COE, and people choose to retain vehicles over Purchasing them, leading to increase in maintenance revenue

70% Market Share and Oligopolistic industry in inspections makes pricing power of VICOM strong, and bargaining of buyers Weak

Grab Comfort Uber having their price wars. Subsidiary of Comfort. Comfort is unlikely to gain much from cutting profit margins and increase cost of goods sold. Vehicle maintenance however is likely to gain from the increase in vehicles on the road, considering it has 70% of market share. Grab and Uber has mandatory inspections too???

Does management have any insight towards any concrete plan from Government?

Is Driverless cars and buses going to be a real thing? Is there any long term direction from management?

Are there any plans for business development and new businesses?

Most Likely hold on buying until management or government gives a distinct Signal.

Trading at slightly above 3 year low, Mixed Signals on Fundamental analysis due to dismal outlook on industry

Monitor COE, Oil and Gas, Government, Comfort Signals

Beta is low, not correlated with STI but correlated with COE Cycle

Threat of New entrants

Vehicle Inspection - NIL

Non Vehicle inspection - Very High Threat, High Likelihood

Bargaining power of suppliers

Vehicle Inspection - Unknown

Non Vehicle inspection - Unknown

Bargaining power of Buyer

Vehicle Inspection - Very Weak, 70% Market Share, Oligopolistic industry, Great Pricing power

Non Vehicle inspection - Very Strong, many competitors offering services

Threat of substitutes in products and Services

Vehicle Inspection - NIL, essential services to be done every 6 months, mandated by law

Non Vehicle inspection - Unknown

Rivalry among existing competition (SGS SA and Bureau Veritas)

Vehicle Inspection - Unknown

Non Vehicle inspection - Unknown

Organisational Life Cycle

What type of stock it is and what I am looking out for. - Mature Company, Stalwart and Dividend

Growth rate - 1.09% based on FY2012to2016 Geometric Mean

Beta - 0.33

CAPM (required rate of Return)( Rename Beta, Obtain adjusted Beta, Use STI ETF as Rm,

- 3.6892

Company Geometric Return - 1.09% based on FY2012to2016 Geometric Mean

2) Financial Ratio Health Analysis with peers

Profitability - Great

| Gross Margin (TTM) (%) | 43.18 |

| Operating Profit Margin (TTM) (%) | 32.06 |

| Net Profit Margin (TTM) (%) | 28.27 |

Liquidity/ Leverage - Incredible, Not Debt at all

Cash Ratio = (Cash + cash equivalents) / Current liability

Current Ratio = (Current Asset / Current Liability)

Debt ratio = (Total Liability / Total Asset)

Quick Ratio

Operating cash flow - increasing steadily, low fluctuation

Investing cash flow - always negative, better over the years

Financing cash flow - always negative, spike in 2014 and 2015

Performance - Mixed

Return on Asset - ROA declining over the years

Sales Turnover - ROE declining over the years

Earnings Per Share - Earnings per share improving gradually

Return on Investment

Tax Retention Rate (tax efficiency, higher better) = (EBIT - tax exp) /EBIT

Interest Expense Rate (lower better) = int exp / Totalasset

Return on Equity - 19.02 (WSJ), Great Profit Margin, Poor Asset Turnover, Great Financial Leverage

Dupont ROE analysis - Profit Margin x Asset Turnover x Financial Leverage

Profit Margin - 27.83

Total Asset Turnover - 0.57

Financial Leverage - 1.19900902093538 (GoalSeek)

ROE = Net Income/Net Sales x Net Sales/Total Asset x Total Asset x Common Equity

3) Valuation Models

1) DDM = V=D(1+g)/(Re-g)

i) Requires consistent Dividend policy and payout

ii) Gorgon constant Growth model

iii) Good to value mature companies with stable growth, profit, dividend growth

iv) Not good to value companies prone to macroeconomic and cyclical factors, large fluctuation in profits and dividend growth

| DDM | 8.03, Undervalued |

| http://www.miniwebtool.com/dividend-discount-model-calculator/ |

| Discount rate: | 3.6892 | ||

| Dividend growth rate: | 0.82 | ||

| Dividends per Share ($): | 0.2304 |

| average Dividend | 0.2304 |

| Projected Dividend Yield based on recent 3 years (Philips) | |

| 0.82 | |

| 2017 Dividend | 0.185 |

| 2016 dividend | 0.2775 |

| 2015 dividend | 0.27 |

| 2014 dividend | 0.2325 |

| 2013 dividend | 0.187 |

2) FCFE

Net Profit After tax

- (CAPEX-dep exp)(1-debt ratio)

- (Change in working capital)(1-debt ratio)

= FCFE

i) Estimate of Equity Capital Usage, Determine whether Dividend and stock repurchases is paid via free cash flow or other financing methods. If FCFE > Dividend payment and cost to buy back shares, Company is using debt of existing capital for share buyback, essentially propping up share price.

ii) Good to value growth companies and start-ups with no dividends.

iii) Cannot value companies with drastic change in working capital.

iv) focus on net profit after tax, ignore cash flow issues such as investments in fixed assets, net borrowings and working capital.

3) Price Earnings Ratio = Market P / Earnings per share -18.26

ii) Use to compare companies within same industry, Low P/E undervalued and great performance, High P/e investors expect high earnings growth

iii) Essential to do Dupont analysis, Can be manipulated by increasing leverage

iii) Not good to Value start-ups, loss making, unstable profits or growth focused company.

iv) Not good to value economies with high inflation, insufficient discounting factors time value of money

4) Price per book value = Market P / Book Value - 3.432

i) Low P / BV = undervalued or fundamental weakness, how much is company worth after liquidating everything

ii) Only use to compare with companies in same industry, with positive book value, short run negative earnings

iii) Not Good for Companies focusing on Branding and Goodwill (BAML), change in accounting methodology, Comparison across countries, Change in technology, change in asset prices (depreciation, amortisation, appreciation), inflation or present market of assets, improved products and services.

iv) Not good for technology companies (No fixed assets) and consistent loss making companies.

5) Price Sales ratio = Market P / Sales per share - 5.088

i) Less Prone to Accounting manipulations, Low P/S undervalued or not profitable

ii) Only compare between close competitors, when company no P/E ratio or no earnings.

iii) Good to value start-ups, growth companies, unprofitable companies at mature phase

iv) Not good as it ignores expenses and liabilities

Compare with Mkt P on fixed date, Over/Under Valued, Buy / sell

DDM

FCFE

P/E

P/B

P/S

4) Buy / Sell Decision

1) Fundamental Target Price Range - Heavily Mixed Signals. Vicom is overvalued even when trading near its 3 year low. If Vicom can sustain its dividend payout it is severely undervalued. All Other ratios suggests Vicom is Overvalued.

2) Consider Support Resistance Lines

3) Consider Technical Analysis input by POEMS

4)Consider Analyst consensus opinion, Favouring stocks with minimal analyst coverage

5) Buffet Valuation Checklist

Business Tenets

1) Is business simple and understandable? (choose companies within your circle of competence, not the size of the circle but rather how defined are its parameters)

2) Does Business have consistent operating history? (Operating performance, Cash Flow especially for SME)

3) Does business have favourable Long term Prospects? (American Steel industries decline, avoid commodities, Porter's 5 forces - choose franchises that products are needed and desired, with no close substitutes, unregulated, quality, weak competitors. branding / quality allowing company to retain market and pricing power to pass on costs to consumers)

Management Tenets

4) Is management rational and track record of competence? (SMRT clowns)

5) Does business have strong track record and consistent good leadership and management (management changes, adopting of technology, recognition of fundamental changes in economy)

6) Does management resist institutional imperative? (Manager Mismanagement and inertia to change)

- The organisation resists any change whatsoever in its current direction, and will seize upon any evidence that they are doing the right thing while fastidiously ignoring evidence to the contrary.

- Just as work expands to fill time, and waistlines expand to fill belts, projects and acquisitions will materialise to soak up all available capital.

- Any business plan of the CEO, however stupid it may be, will receive immediate support from a legion of lackeys who will produce copious data and detailed rate of return and strategic studies to support the boss's thesis.

- The behaviour of peer companies, irrespective of differences in circumstances, whether they are acquiring, expanding, setting dividend policy, downsizing, putting the troops through customer service training or setting executive compensation will be immediately and thoughtlessly copied.

- Poor capital management skills. Buffet buying over entire companies to decide financing policy )

Financial Tenets

7) What is the ROE? (Revenue, Expenses, Cash Flow, Labour relations, pricing flexibility, capital allocation needs). Look out for cash flow, indebtness and changes in interest rates

8) What is the company's owner earnings?

9) What are the operating margins?

10) Has company created at least 1 dollar of market value for every dollar retained?

Value Tenets

11) What is the value of the company (Intrinsic, Book, Market). Buy a good company at an undervalued Price. Buy a very good company at a fair price as good companies are closely monitored

12) Can it be purchased as significant discount to its value? (undervalued, Very good prospects / projects)

Reflection

1) I am glad that VICOM despite being poorly covered in mainstream stockbroker analysis, has a wealth of knowledge covered by amateur investors. I owe them a lot and also learned a lot. However, actual fundamental analysis based on valuation model is really poor. I am glad I have retained my Investment Analysis Project knowledge and able to utilise them to the fullest extent.

2) I realised that with each additional analysis I conduct, I tend to get more detailed and more valuation model focused. Previously, I invest based on optimism and cyclical lows. This company is very difficult to evaluate based on outlook as the decline of the industry is certain and the fundamentals are deteriorating along with the price. I will monitor the fundamentals closely as it is a good company but doing poorly due to market outlook. I will look out for COE, government signals and Vicom Press release and buy based on events or price shocks, if available.

3) My father being knowledgable in vehicle inspection has briefed me a lot about the workings of the vehicle inspection process. I am glad to have his knowledge but I believe I might want to schedule a trip down for vehicle maintenance to see how it operates on the ground,

Comments

Post a Comment