Singtel

Singtel

http://quotes.wsj.com/SG/XSES/Z77/financials

http://financials.morningstar.com/valuation/price-ratio.html?t=Z74®ion=SGP&culture=en_US

https://www.dbs.com.sg/treasures/aics/templatedata/article/recentdevelopment/data/en/DBSV/012017/ST_SP_01232017.xml?sessioncheck=true

http://www.miniwebtool.com/dividend-discount-model-calculator/?n1=6.9716&n2=6.835443038&n3=0.07

Decision to Buy - Undervalued, Great dividend gain, Stalwart (Ok growth), expect to grow from emerging markets but incurring currency and translation risk, Good Cash flow backed by assets, unlikely to go bankrupt, Buying while market overreacts and reeling from spectrum bid and fourth telco

1) Business Outlook

Lines of business + Prospects

2) SWOT

P

E

S

T

I am interested in Singtel and telcos as I believe they are the future. Telcos from a scientific and financial viewpoint is a utility and essential good. Corporate and retail users rely on it for their leisure, business, purchases, marketing, financial services increasingly as Singapore restructures to a smart nation. Looking at the restaurants and public transport, everyone is tapping on telcos and internet for their leisure and Businesses. Even a short outage at Jurong for an hour can lead to social media fighting mini online battles with Internet providers. E-commerce, digital marketing, online payments all depend on Internet accessibility and Singtel has deep penetration in Singapore and is looking forward to growing at emerging markets. Singtel essentially build infrastructure at high fixed cost, but incurs low variable costs and infinite profit thereon. From a Beta Standpoint, Costs are set to increase with higher energy prices, whereby my holdings at HyFlux can hedge this risk.

From my line of business standpoint, Digital transmission of data to clearing houses and settlements function, as well as STP is going to be the future. All these trends increasingly rely on the usage of Internet and digital security, which Singtel is investing extensively in. Backup lines from other telcos are even bought in the event of telcos outage. Corporate functions, digital marketing, Public relations, Internet Sales and distribution, Operational functions all rely on telecommunications and all these companies will be contributing to Telcos bottom line. From a national security standpoint, I believe Singtel is also the future. It also enjoy special attention from Singapore government and TH, to the point that special discounted shares are issued via CPF

From my own personal experience, Singtel is horrendously expensive and enjoys great profit margin. The complexity of their price plans can trick the financially gullible to buy services that do not require at a higher price. Singtel also sell smartphones at the so called market rate, but essentially they buy in bulk and incur cost savings, sell and market their phones through contract upgrade and renewal, in turn locking the client cash flow and subscriptions. They also continually obsolete the plans that does not bring them good profit margin (MIO Plan). The process of changing telcos is exceedingly complex and convoluted. Even my father, whom is outspoken in the unhappiness over Singtel's increasing prices, is continually subscribing to it as he cannot afford to change numbers, and his long term subscription had gave him good rates that is difficult for him to pull away from.

Their business model has been shifting from a traditional profit from calls, home-lines, SMS and MMS to increasingly digital services driven. Smartphone distribution, home broadband and mobile data plans. With the forced obsolete-ion of 2G plans by the government in order to provide more bandwidth for 5G, it is a dirty play and ascertain the protection that Telcos enjoy, from free-play on bandwidth to additional sales of 3G Phones.

While Smartphone companies are fighting their price wars and innovation wars, Telcos are not spared from it too. The recent entry of the TPG Telecom may signal that that that the oligopolistic industry of Singapore telecommunications industry is shaken. No one knows for certain what will come next. With fourth telcos bidding for the spectrum auction, the golden age of great profits in Singapore may be finally over.

ii) Group Enterprise

iii) Group Digital Life.

Group Consumer segment comprises the consumer businesses across Singapore and Australia, as well as the Company's investments in Thailand, India, Africa, South Asia, Philippines and Indonesia.

Group Enterprise segment comprises the business groups across Singapore, Australia, the United States, Europe and the region.

Group Digital Life segment focuses on using the Internet technologies and assets of the Company's operating companies by entering adjacent businesses.

2) Porter 5 Forces (Pricing Power)(Franchising)

Threat of New entrants - TPG Telcom, but New Telcos failed to capture market share competitively. Branding of Singtel is still there and other telcos still occupy smaller market share. Bidding of the infrastructure and spectrum requires large funding and the process is surprisingly difficult and small firms like MyRepublic are unable to enter despite the comparative advantages they offer.

Bargaining power of suppliers - Cosy business relationships with IDA, Singapore Government. Unlikely to undercut Singtel in any meaningful way. Not sure about Australia and other countries.

Bargaining power of Buyer - In Singapore, Due to oligopolistic nature of industry prices are largely the same between telcos. Retail Buyers enjoy much bargaining power, but not much choice between telcos. Corporate plans are largely locked in however and telecommunications facilities cannot be changed easily.

Unsure whether Singtel successful anchors the brand loyalty of consumers in developing countries

Threat of substitutes in products and Services - NIL. Might incur product cannibalisation in 3G 4G and 5G

Rivalry among existing competition - Yes, between 4 telcos. They are unable to provide significant cost savings or comparative advantages compared to Singtel however. They are largely involved in price competition and making Singapore a red ocean.

Organisational Life Cycle

http://quotes.wsj.com/SG/XSES/Z77/financials

http://financials.morningstar.com/valuation/price-ratio.html?t=Z74®ion=SGP&culture=en_US

https://www.dbs.com.sg/treasures/aics/templatedata/article/recentdevelopment/data/en/DBSV/012017/ST_SP_01232017.xml?sessioncheck=true

http://www.miniwebtool.com/dividend-discount-model-calculator/?n1=6.9716&n2=6.835443038&n3=0.07

Decision to Buy - Undervalued, Great dividend gain, Stalwart (Ok growth), expect to grow from emerging markets but incurring currency and translation risk, Good Cash flow backed by assets, unlikely to go bankrupt, Buying while market overreacts and reeling from spectrum bid and fourth telco

1) Business Outlook

Lines of business + Prospects

2) SWOT

P

E

S

T

I am interested in Singtel and telcos as I believe they are the future. Telcos from a scientific and financial viewpoint is a utility and essential good. Corporate and retail users rely on it for their leisure, business, purchases, marketing, financial services increasingly as Singapore restructures to a smart nation. Looking at the restaurants and public transport, everyone is tapping on telcos and internet for their leisure and Businesses. Even a short outage at Jurong for an hour can lead to social media fighting mini online battles with Internet providers. E-commerce, digital marketing, online payments all depend on Internet accessibility and Singtel has deep penetration in Singapore and is looking forward to growing at emerging markets. Singtel essentially build infrastructure at high fixed cost, but incurs low variable costs and infinite profit thereon. From a Beta Standpoint, Costs are set to increase with higher energy prices, whereby my holdings at HyFlux can hedge this risk.

From my line of business standpoint, Digital transmission of data to clearing houses and settlements function, as well as STP is going to be the future. All these trends increasingly rely on the usage of Internet and digital security, which Singtel is investing extensively in. Backup lines from other telcos are even bought in the event of telcos outage. Corporate functions, digital marketing, Public relations, Internet Sales and distribution, Operational functions all rely on telecommunications and all these companies will be contributing to Telcos bottom line. From a national security standpoint, I believe Singtel is also the future. It also enjoy special attention from Singapore government and TH, to the point that special discounted shares are issued via CPF

From my own personal experience, Singtel is horrendously expensive and enjoys great profit margin. The complexity of their price plans can trick the financially gullible to buy services that do not require at a higher price. Singtel also sell smartphones at the so called market rate, but essentially they buy in bulk and incur cost savings, sell and market their phones through contract upgrade and renewal, in turn locking the client cash flow and subscriptions. They also continually obsolete the plans that does not bring them good profit margin (MIO Plan). The process of changing telcos is exceedingly complex and convoluted. Even my father, whom is outspoken in the unhappiness over Singtel's increasing prices, is continually subscribing to it as he cannot afford to change numbers, and his long term subscription had gave him good rates that is difficult for him to pull away from.

Their business model has been shifting from a traditional profit from calls, home-lines, SMS and MMS to increasingly digital services driven. Smartphone distribution, home broadband and mobile data plans. With the forced obsolete-ion of 2G plans by the government in order to provide more bandwidth for 5G, it is a dirty play and ascertain the protection that Telcos enjoy, from free-play on bandwidth to additional sales of 3G Phones.

While Smartphone companies are fighting their price wars and innovation wars, Telcos are not spared from it too. The recent entry of the TPG Telecom may signal that that that the oligopolistic industry of Singapore telecommunications industry is shaken. No one knows for certain what will come next. With fourth telcos bidding for the spectrum auction, the golden age of great profits in Singapore may be finally over.

http://sbr.com.sg/telecom-internet/news/total-bids-spectrum-auction-reach-114b

Singtel bid the highest at $563.7m, and was provisionally awarded 75MHz.

Meanwhile, StarHub bid $349.6m for 60MHz; M1 submitted a $208m bid for

30MHz; and the new kid on the block TPG bid the lowest at $23.8 for

10MHz.

Yes, Singtel is transiting to a red ocean, but Singtel is looking into developing business in countries that are not yet so heavily contested. 24% Australia, 29% Singapore, 47% regional business. To be frank I am making an optimistic call on this one as I do not understand the local business conditions of these countries. In 2016 alone, the emerging economics sector recorded good profits but translation risk and currency wiped out the good profits. Book value and currency holdings is unaffected however. After the height in 2012, 2013 faced a massive decline but revenues has been steadily improving since 2013 until now. It is fairly valued a few months ago until the telcos bidding shocked the market to undervaluing it. Share Buyback incurred on 10 Feb 2017.

Lines of business

i) Group Consumerii) Group Enterprise

iii) Group Digital Life.

Group Consumer segment comprises the consumer businesses across Singapore and Australia, as well as the Company's investments in Thailand, India, Africa, South Asia, Philippines and Indonesia.

Group Enterprise segment comprises the business groups across Singapore, Australia, the United States, Europe and the region.

Group Digital Life segment focuses on using the Internet technologies and assets of the Company's operating companies by entering adjacent businesses.

2) Porter 5 Forces (Pricing Power)(Franchising)

Threat of New entrants - TPG Telcom, but New Telcos failed to capture market share competitively. Branding of Singtel is still there and other telcos still occupy smaller market share. Bidding of the infrastructure and spectrum requires large funding and the process is surprisingly difficult and small firms like MyRepublic are unable to enter despite the comparative advantages they offer.

Bargaining power of suppliers - Cosy business relationships with IDA, Singapore Government. Unlikely to undercut Singtel in any meaningful way. Not sure about Australia and other countries.

Bargaining power of Buyer - In Singapore, Due to oligopolistic nature of industry prices are largely the same between telcos. Retail Buyers enjoy much bargaining power, but not much choice between telcos. Corporate plans are largely locked in however and telecommunications facilities cannot be changed easily.

Unsure whether Singtel successful anchors the brand loyalty of consumers in developing countries

Threat of substitutes in products and Services - NIL. Might incur product cannibalisation in 3G 4G and 5G

Rivalry among existing competition - Yes, between 4 telcos. They are unable to provide significant cost savings or comparative advantages compared to Singtel however. They are largely involved in price competition and making Singapore a red ocean.

Organisational Life Cycle

What type of stock it is and what I am looking out for. Stable non cyclical company, Stalwart and dividend stock. Enjoy steady sustained growth mainly in emerging markets. Great dividend stock with stable dividend, dividend payout ratio is between 60% to 75% of underlying net profit.

Growth rate

Beta - 0.95

CAPM (required rate of Return)( Rename Beta, Obtain adjusted Beta, Use STI ETF as Rm,

Company Geometric Return on Net income (Net Income, 2012 to 2016) = 9.4%

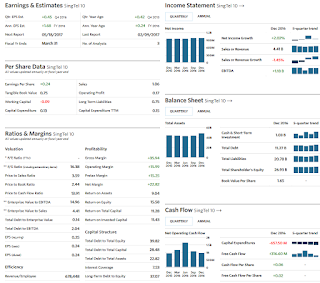

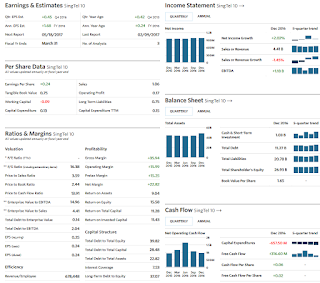

2) Financial Ratio Health Analysis with peers

Profitability - Very Healthy, Cash Fow is generally healthy, sharp decrease in 2016 due to FOREX, Singtel is generally drawing down on its cash balance

Liquidity/ Leverage - Good Cash Flow and liquidity in the short run and long run, Relative low indebtedness considering its Infrastructure, Very Good Free Cash Flow, Although Singtel drawing down on it, Low Leverage ratio

Cash Ratio = (Cash + cash equivalents) / Current liability

Current Ratio = (Current Asset / Current Liability)

Debt ratio = (Total Liability / Total Asset)

Quick Ratio

Operating cash flow

Investing cash flow

Financing cash flow

Performance - Singtel is slowing down in growth, focus on dividend play rather than growth

Return on Asset - OK

Sales Turnover - OK

Earnings Per Share - Good

Return on Investment -

Tax Retention Rate (tax efficiency, higher better) = (EBIT - tax exp) /EBIT

Interest Expense Rate (lower better) = int exp / Total asset

Return on Equity

Dupont ROE analysis - Profit Margin x Asset Turnover x Financial Leverage

ROE = Net Income/Net Sales x Net Sales/Total Asset x Total Asset x Common Equity

3) Valuation Models

Compare with Mkt P on fixed date, Over/Under Valued, Buy / sell

DDM - Undervalued

FCFE -Drawing down on free cash flow, worsening

P/E - 15.7

P/B - 2.3

P/S - 3.7

4) Buy / Sell Decision

1) Fundamental Target Price Range - Buy

2) Consider Support Resistance Lines - Buy at 3.770

3) Consider Technical Analysis input by POEMS -Short term bearish signals.

4)Consider Analyst consensus opinion, Favouring stocks with minimal analyst coverage -Mainly of the opinion to Buy / Hold

5) Buffet Valuation Checklist

Business Tenets

1) Is business simple and understandable? (choose companies within your circle of competence, not the size of the circle but rather how defined are its parameters) - Yes for Singapore, Much Uncertainty in Foreign countries

2) Does Business have consistent operating history? (Operating performance, Cash Flow especially for SME) - Yes for Singapore, Much Uncertainty in Foreign countries

3) Does business have favourable Long term Prospects? (American Steel industries decline, avoid commodities) - Yes Globally, Especially Emerging markets

Porter's 5 forces - choose franchises that products are needed and desired, with no close substitutes, unregulated, quality, weak competitors. branding / quality allowing company to retain market and pricing power to pass on costs to consumers) - Essential Utility Commodity in Singapore and globally, Significant pricing power in Oligopoly market structure for corporate clients,

Management Tenets

4) Is management rational and track record of competence? (Beware SMRT clowns) - Yes

5) Does business have strong track record and consistent good leadership and management (management changes, adopting of technology, recognition of fundamental changes in economy) - Yes

6) Does management resist institutional imperative? (Manager Mismanagement and inertia to change) - Unlikely, embracing new networks and technology

Financial Tenets

7) What is the ROE? (Revenue, Expenses, Cash Flow, Labour relations, pricing flexibility, capital allocation needs). Look out for cash flow, indebtness and changes in interest rates - Good

8) What is the company's owner earnings? - Reasonable

9) What are the operating margins? - Good

10) Has company created at least 1 dollar of market value for every dollar retained? - Yes

Value Tenets

11) What is the value of the company (Intrinsic, Book, Market). Buy a good company at an undervalued Price. Buy a very good company at a fair price as good companies are closely monitored

Buy Great company at undervalued Price, Projecting that market overreacted negatively due to 2 shock events

12) Can it be purchased as significant discount to its value? (undervalued, Very good prospects / projects) - YES

Final Conclusion

I choose to buy this Stalwart stock at SGD 3.750, with payout ratio close to a dividend stock. I hope for it to increase its capital gain to SGD 4.236 in the long run, and meanwhile I can rely on its dividend gain to reap its good value. The market is telling me that over the course of 3 years, Singtel has 0 gain in market value which is absurd. I really hope that the next development of Trump and his global politics antics can drive pessimism further down and I can reap the rewards. I checked the market depth report of my broker and many others are bidding at 3.760, whereby I priced it slightly lower at the natural resistance line of 3.750. Trend and momentum traders, fuel my greed! Break the resistance lines and give me my stock.

Singapore's market is expected to have slow growth due to over-saturation of the market, and the overreaction to spectrum prices. However, Singtel had diversified earnings from other markets, and profit actually rose over 5 years. For-ex and translation risks definitely eroded the value of SGD earnings, but it shouldn't affect its bottom line as Singtel has no need to change its currency holdings now. Good Cash flow backed by assets, unlikely to go bankrupt. Share buyback has fundamental effects on supporting share price, and suggest insiders have a good read on the situation to initiate this process.

Singtel gains from Spectrum bandwidth in the long run as they have more resources and pricing power to sell its 3G-5G spectrum and the unprofitable 2G is forced to obsolete. Singtel has locked in clients and corporate clients will most likely adopt the prices that Singtel has to offer, as they cannot readily switch bandwidth providers and need to adopt the better technology. Retail segments may suffer from price competition, and I do not know the future that 5G holds.

It took time for me to realise that bottom up analysis is vastly different from Top Bottom Analysis. With the volatility nowadays and prices going haywire, top down fundamentals is hardly a useful tool to gauge the outlook of a specific company, rather indexes will be more meaningful. Bottom up Fundamental Tenets allowed me to keep a level head on specific companies in the face of great uncertainty. There is no way to predict whether my trade will even go through, and I am just banking the price to hit natural resistance line of 3.75.

I admit Warren Buffet and Peter Lynch has largely affected my outlook on investing. I will continue to read up on their investing perspectives, and fund managers that has consistently outperformed most others. I do not yearn to be the best, just the top 25% will do.

Growth rate

Beta - 0.95

CAPM (required rate of Return)( Rename Beta, Obtain adjusted Beta, Use STI ETF as Rm,

| =11.2719% |

2) Financial Ratio Health Analysis with peers

Profitability - Very Healthy, Cash Fow is generally healthy, sharp decrease in 2016 due to FOREX, Singtel is generally drawing down on its cash balance

| Gross Margin (TTM) (%) | 71.12 |

| Operating Profit Margin (TTM) (%) | 16.23 |

| Net Profit Margin (TTM) (%) | 23.13 |

Liquidity/ Leverage - Good Cash Flow and liquidity in the short run and long run, Relative low indebtedness considering its Infrastructure, Very Good Free Cash Flow, Although Singtel drawing down on it, Low Leverage ratio

| Current Ratio | 0.79 |

| Quick Ratio | 0.74 |

| Long Term Debt to Equity (%) | 37.07 |

| Total Debt to Equity (%) | 39.82 |

| Interest Coverage Ratio (TTM) | - |

| Free Cash Flow to Firm (TTM) (SGD 'mln) | 1,631.80 |

Cash Ratio = (Cash + cash equivalents) / Current liability

Current Ratio = (Current Asset / Current Liability)

Debt ratio = (Total Liability / Total Asset)

Quick Ratio

Operating cash flow

Investing cash flow

Financing cash flow

Performance - Singtel is slowing down in growth, focus on dividend play rather than growth

Return on Asset - OK

Sales Turnover - OK

Earnings Per Share - Good

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Retention Rate (tax efficiency, higher better) = (EBIT - tax exp) /EBIT

Interest Expense Rate (lower better) = int exp / Total asset

Return on Equity

Dupont ROE analysis - Profit Margin x Asset Turnover x Financial Leverage

ROE = Net Income/Net Sales x Net Sales/Total Asset x Total Asset x Common Equity

3) Valuation Models

Compare with Mkt P on fixed date, Over/Under Valued, Buy / sell

DDM - Undervalued

FCFE -Drawing down on free cash flow, worsening

P/E - 15.7

P/B - 2.3

P/S - 3.7

4) Buy / Sell Decision

1) Fundamental Target Price Range - Buy

2) Consider Support Resistance Lines - Buy at 3.770

3) Consider Technical Analysis input by POEMS -Short term bearish signals.

4)Consider Analyst consensus opinion, Favouring stocks with minimal analyst coverage -Mainly of the opinion to Buy / Hold

5) Buffet Valuation Checklist

Business Tenets

1) Is business simple and understandable? (choose companies within your circle of competence, not the size of the circle but rather how defined are its parameters) - Yes for Singapore, Much Uncertainty in Foreign countries

2) Does Business have consistent operating history? (Operating performance, Cash Flow especially for SME) - Yes for Singapore, Much Uncertainty in Foreign countries

3) Does business have favourable Long term Prospects? (American Steel industries decline, avoid commodities) - Yes Globally, Especially Emerging markets

Porter's 5 forces - choose franchises that products are needed and desired, with no close substitutes, unregulated, quality, weak competitors. branding / quality allowing company to retain market and pricing power to pass on costs to consumers) - Essential Utility Commodity in Singapore and globally, Significant pricing power in Oligopoly market structure for corporate clients,

Management Tenets

4) Is management rational and track record of competence? (Beware SMRT clowns) - Yes

5) Does business have strong track record and consistent good leadership and management (management changes, adopting of technology, recognition of fundamental changes in economy) - Yes

6) Does management resist institutional imperative? (Manager Mismanagement and inertia to change) - Unlikely, embracing new networks and technology

- The organisation resists any change whatsoever in its current direction, and will seize upon any evidence that they are doing the right thing while fastidiously ignoring evidence to the contrary.

- Just as work expands to fill time, and waistlines expand to fill belts, projects and acquisitions will materialise to soak up all available capital.

- Any business plan of the CEO, however stupid it may be, will receive immediate support from a legion of lackeys who will produce copious data and detailed rate of return and strategic studies to support the boss's thesis.

- The behaviour of peer companies, irrespective of differences in circumstances, whether they are acquiring, expanding, setting dividend policy, downsizing, putting the troops through customer service training or setting executive compensation will be immediately and thoughtlessly copied.

- Poor capital management skills. Buffet buying over entire companies to decide financing policy )

Financial Tenets

7) What is the ROE? (Revenue, Expenses, Cash Flow, Labour relations, pricing flexibility, capital allocation needs). Look out for cash flow, indebtness and changes in interest rates - Good

8) What is the company's owner earnings? - Reasonable

9) What are the operating margins? - Good

10) Has company created at least 1 dollar of market value for every dollar retained? - Yes

Value Tenets

11) What is the value of the company (Intrinsic, Book, Market). Buy a good company at an undervalued Price. Buy a very good company at a fair price as good companies are closely monitored

Buy Great company at undervalued Price, Projecting that market overreacted negatively due to 2 shock events

12) Can it be purchased as significant discount to its value? (undervalued, Very good prospects / projects) - YES

Final Conclusion

I choose to buy this Stalwart stock at SGD 3.750, with payout ratio close to a dividend stock. I hope for it to increase its capital gain to SGD 4.236 in the long run, and meanwhile I can rely on its dividend gain to reap its good value. The market is telling me that over the course of 3 years, Singtel has 0 gain in market value which is absurd. I really hope that the next development of Trump and his global politics antics can drive pessimism further down and I can reap the rewards. I checked the market depth report of my broker and many others are bidding at 3.760, whereby I priced it slightly lower at the natural resistance line of 3.750. Trend and momentum traders, fuel my greed! Break the resistance lines and give me my stock.

Singapore's market is expected to have slow growth due to over-saturation of the market, and the overreaction to spectrum prices. However, Singtel had diversified earnings from other markets, and profit actually rose over 5 years. For-ex and translation risks definitely eroded the value of SGD earnings, but it shouldn't affect its bottom line as Singtel has no need to change its currency holdings now. Good Cash flow backed by assets, unlikely to go bankrupt. Share buyback has fundamental effects on supporting share price, and suggest insiders have a good read on the situation to initiate this process.

Singtel gains from Spectrum bandwidth in the long run as they have more resources and pricing power to sell its 3G-5G spectrum and the unprofitable 2G is forced to obsolete. Singtel has locked in clients and corporate clients will most likely adopt the prices that Singtel has to offer, as they cannot readily switch bandwidth providers and need to adopt the better technology. Retail segments may suffer from price competition, and I do not know the future that 5G holds.

It took time for me to realise that bottom up analysis is vastly different from Top Bottom Analysis. With the volatility nowadays and prices going haywire, top down fundamentals is hardly a useful tool to gauge the outlook of a specific company, rather indexes will be more meaningful. Bottom up Fundamental Tenets allowed me to keep a level head on specific companies in the face of great uncertainty. There is no way to predict whether my trade will even go through, and I am just banking the price to hit natural resistance line of 3.75.

I admit Warren Buffet and Peter Lynch has largely affected my outlook on investing. I will continue to read up on their investing perspectives, and fund managers that has consistently outperformed most others. I do not yearn to be the best, just the top 25% will do.

Comments

Post a Comment