Silver Lake axis EGM

Silver Lake axis EGM

(1) THE PROPOSED ACQUISITION OF:

(A) 70% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF SILVERLAKE DIGITAL ECONOMY SDN BHD,SILVERLAKE DIGITALE SDN BHD AND SILVERLAKE ONE PARADIGM SDNBHD (COLLECTIVELY, THE “TARGET ENTITIES”), HELD BY SILVERLAKE INVESTMENT LTD (“SIL”), PURSUANT TO THE ACQUISITION OF THE ENTIRE ISSUED AND PAID-UP SHARE CAPITAL OF SIL (“SIL SHARES”), AS AN INTERESTED PERSON TRANSACTION; AND

(B) THE BALANCE 30% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF EACH OF THE TARGET ENTITIES, FROM THE MINORITY SHAREHOLDER(S) OF EACH TARGET E NTITY (COLLECTIVELY, THE “MINORITY SELLERS”), WHICH, TOGETHER WITH THE ACQUISITION OF THE SIL SHARES, CONSTITUTES A POTENTIAL MAJOR ACQUISITION, (COLLECTIVELY, THE “PROPOSED SHARE ACQUISITION”);

(1) THE PROPOSED ACQUISITION OF:

(A) 70% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF SILVERLAKE DIGITAL ECONOMY SDN BHD,SILVERLAKE DIGITALE SDN BHD AND SILVERLAKE ONE PARADIGM SDNBHD (COLLECTIVELY, THE “TARGET ENTITIES”), HELD BY SILVERLAKE INVESTMENT LTD (“SIL”), PURSUANT TO THE ACQUISITION OF THE ENTIRE ISSUED AND PAID-UP SHARE CAPITAL OF SIL (“SIL SHARES”), AS AN INTERESTED PERSON TRANSACTION; AND

(B) THE BALANCE 30% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF EACH OF THE TARGET ENTITIES, FROM THE MINORITY SHAREHOLDER(S) OF EACH TARGET E NTITY (COLLECTIVELY, THE “MINORITY SELLERS”), WHICH, TOGETHER WITH THE ACQUISITION OF THE SIL SHARES, CONSTITUTES A POTENTIAL MAJOR ACQUISITION, (COLLECTIVELY, THE “PROPOSED SHARE ACQUISITION”);

(2) THE PROPOSED EXECUTION OF (A) THE SYMMETRY LICENCE AND (B ) THE TRANSITIONAL SERVICES AGREEMENT (COLLECTIVELY, THE “PROPOSED ANCILLARY AGREEME NTS”), IN CONJUNCTION WITH THE PROPOSED SHARE ACQUISITION, AS INTERESTED PERSON TRANSACT IONS; AND

(3) THE PROPOSED ISSUE OF UP TO 661,654,400 ORDINARY SHARES ( “CONSIDERATION SHARES”) IN THE CAPITAL OF THE COMPANY, AT AN ISSUE PRICE OF NO LESS THAN S$0.7 1 PER ORDINARY SHARE (“SHARE”), AS CONSIDERATION FOR THE PROPOSED SHARE ACQUISI TION COMPRISING

(A) AN AGGREGATE OF UP TO 463,158,080 SHARES TO BE ISSUED TO THE CONT ROLLING SHAREHOLDER OF THE COMPANY, GOH PENG OOI, AS AN INTERESTED PERSON TRANSACTI ON; AND

(B) AN AGGREGATE OF UP TO 198,496,320 SHARES TO BE ISSUED TO THE MINORITY SELLERS (COLLECTIVELY, THE “PROPOSED CONSIDERATION SHARE ISSUE”), (COLLECTIVELY, THE “PROPOSED TRANSACTION”).

4) EGM Location

Oriental Ballroom 1, Lobby Level, Mandarin Oriental Singapore, 5 Raffles Avenue, Marina Square, Singapore 039797 on 1 March 2018 at 2.30 p.m

Situation analysis

For November and December, SLA is issuing share buybacks to boost the EPS of the company. Goh Peng Ooi is increasing his stake in the company.

He is a major shareholder in three subsidiaries (SDE, SDS, SOP) and wish to consolidate these subsidies into SLA. He is an interested party and has cleared the IPT with the audit committees to prevent the razor short sellers from attacking the company. He will be taking over the companies and incorporating into SLA.

SLA is initiating this acquisition not utilising cash but stock to finance this acquisition of subsidiaries. He is issuing shares priced at $0.71 per share above market price to minority shareholders. The Base Consideration Shares shall rank pari passu in all respects with the existing Shares. In short, Goh was then doing share buyback to improve Earnings per share, and now he is diluting earnings per share to finance acquisitions.

According to SLA, the Agreed Issue Price represents a 20.18% premium to the volume weighted average price of Shares traded on the SGX-ST on 19 October 2017, being the market day preceding the date of the SPA, of S$0.5908, and was negotiate d in good faith and arrived at on a willing seller willing buyer basis, taking in to account the parties’ optimism in the longer-term benefits that the Proposed Transaction w ill bring to the Company. The higher price reduces the number of Consideration Shares that are required to be issued, which is less dilutive for the Minority Shareholders of the Company. Aggregate of 70,108,333 Shares (“Base Consideration Shares”) will be issued to the Sellers

What to ask in the EGM

1) To my understanding, SilverLake Axis is conducting share buyback to

boost the earnings per share for the benefit shareholders.

Now, it suddenly did the reverse and is diluting shareholders earnings per share.

What is the reason for share buyback from Nov-Dec if you are planning on diluting shareholder EPS?

Shouldn't you hold off the share buyback and focus on accumulating cash for the purpose of acquisition?

Why is these acquisitions paid for in shares and not in cash?

Now, it suddenly did the reverse and is diluting shareholders earnings per share.

What is the reason for share buyback from Nov-Dec if you are planning on diluting shareholder EPS?

Shouldn't you hold off the share buyback and focus on accumulating cash for the purpose of acquisition?

Why is these acquisitions paid for in shares and not in cash?

2) Is there any strong reason why the minority shareholders of the subsidiaries, is willing to pay a premium for SLA shares? Given the current stock correction?

3) Is it possible to describe the nature of the subsidiaries from the perspective of the layman. I believe there will be technical personnel, banking executives as well as normal shareholders whom will be concerned with these acquisitions.

SDE (creating transformational solutions for the banking industry, in a digital world)

- Software licensing, project services, maintenance and enhancements

- Lumpy cash flow and revenue of business

- Increased revenue, profit margin, Gross profit, Profits after tax

- securing of two major contracts for digital banking solutions from the banks in Brunei Darussalam , Sri Lanka in United Arab Emirates

SDS

- ‘IntelliSuite’software modules and components, that is targeted at financial institutions and emerging non-bank payment providers and aims to provide faster and more innovative solutions, across the consumer/retail and wholesale/corporate payment spectrum.

- IntelliPayz single platform which converges with digital technology to offer mobile wallet payments(namely Google Pay, Apple Pay, AliPay, Wechat Pay, Samsung Pay,et cetera), social payments, and person-to-person payments.. ‘IntelliPayz’ solution also utilises digital security functionalities such as biometric authentication and tokenisation.

- ‘IntelliSwitchz’ regional payment switch to facilitate end-to-end cross-border payment transactions. It is embedded with performance and fraud monitoring.

- end-customers include Krungthai Card PCL (“KTC Thailand”), OCBC Bank(Malaysia) Berhad, CIMB Bank Berhad (“CIMB Bank”), Hong Leong Bank Berhad(“Hong Leong Bank”), Bank Islam Malaysia Berhad (“Bank Islam”), Bank MuamalatMalaysia Berhad (“Bank Muamalat”) and Commercial Bank International PSC.

-Increasing revenue, gross profit, profit margin from customised software solutions,software enhancement and maintenance services

- Will the block-chain initiative by MAS erode the moat / viability of this business?

SOP

- NowSuite, Business users are able to self-define their business rules or criteria without depending on information technology to make coding changes to the core systems

- Please explain to the Layman what it means.

- Please explain to the Layman what it means.

- End clients - Bank Islam, Bank Muamalat, Hong Leong Bank and KTC Thailand

- Company still loss making. Question Goh why he is not waiting for company to prove itself but rushing to acquire it.

- Loss before tax of RM154,886 and loss after tax of RM179,088 were mainly due to delays in the commencement of a project and contracts to be awarded. With Bank Negara Malaysia setting up Payments Network Malaysia Sdn Bhd (“PayNet”) since July 2017 to take over Malaysia’s shared payments infrastructure operations and accelerate the migration to new payment channels, management of SOP is of the view that it is well positioned to introduce their innovative product suite to meet the national initiative of implementing a real-time payment platform which has to be complied by all Malaysian banks. What if it fails to acquire this government contract? Is there any strong indication to justify its success?

5) Is it OK to share for insure-tech business, who are your major clients? Who are your major competitors?

6) What do you think about recent fin-tech developments and block chain? Will your business be negatively affected by them? Especially the SDS payments acquisition?

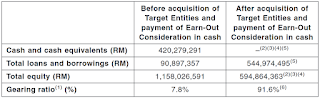

7) Why is there so much gearing and borrowing done to finance these acquisitions? Will it be better to evaluate the acquisitions as it may threaten the financial viability of the business? Especially for Loss making SOP?

8) Will it be better to make these acquisitions are a slower pace as there is no guarantee of success, especially in the fast changing technology business? The GIT proceeds can be utilized for many other purposes.

Group has available-for-sale financial assets in relation to GIT shares which could be sold to raise cash in the event of payment of the Earn-Out Consideration in cash. If such GIT shares were sold at book value as at 30 June 2017 for approximately RM280.31 million, the gearing would be reduced to 44.5%.

8) Will it be better to make these acquisitions are a slower pace as there is no guarantee of success, especially in the fast changing technology business? The GIT proceeds can be utilized for many other purposes.

Group has available-for-sale financial assets in relation to GIT shares which could be sold to raise cash in the event of payment of the Earn-Out Consideration in cash. If such GIT shares were sold at book value as at 30 June 2017 for approximately RM280.31 million, the gearing would be reduced to 44.5%.

9) Are you overpaying for these acquisitions whom has no guarantee of success?

I have read through the IFA but still have my doubts. The business of

the Target Entities may be affected by the inability to protect or

enforce their intellectual property rights among other risks stated in

the circular.

Comments

Post a Comment