Singtel Annual Review 2018

High level overview

High level overviewSingtel is one of the largest holdings in my pip squeak portfolio. I have started averaging down on it since it has dropped from its previous highs to around SGD 3.70, as I believe the company is fundamentally sound despite the threat of the forth telco. I have started accumulation at the occasional dips /bears after considering technical analysis and resistance lines, as well as the quarterly financial reports.

Singtel is a company that most people will view as boring and a dumb pipe, while in fact it has been restructuring to a digital business and engaged with exciting business prospects. Singtel has been actively looking out for opportunities and threats. Presently, due to the emergence of emerging technologies such as whatsapp, we-chat as well as the TPG telco, it is diversifying out of sunset business such as traditional voice call, SMS and MMS business. It is trying to leverage on its existing infrastructure and doing wholesale sale of data / bandwidth to virtual telcos, presumably to crowd out the forth telco offerings. It has been offering sizeable data packages as new product offerings.

From my understanding, the virtual telcos (Circus Life, Zero mobile, Zero One, My Republic) are competitors in the high volume data business with Singtel, but complements in the traditional telco business such as SMS and voice call. Singtel is focusing on the wholesale business by selling large data packages to the virtual telcos to crowd out TPG in the short run. Ultimately, as the chief supplier and the landlord of the bandwidth, Singtel still possess significant pricing power and price leadership to raise prices and keep the virtual telcos in check when required.

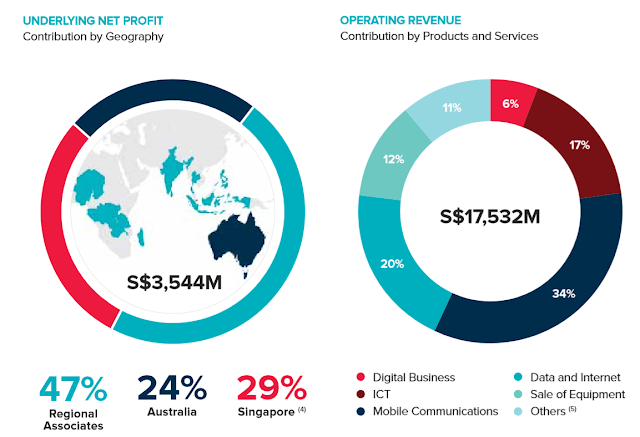

With regarding to emerging markets, Singtel is fighting a three pronged price war at Singapore, Australia, and India (Particularly bloody and violent). Singtel is also simultaneous trying to restructure into a digital business. It is trying to enter new lines of business such as IOT, digital marketing and cybersecurity, and have invested substantial capital to build up the infrastructure.

Regarding the tendering of major projects, Singtel has successfully bid for projects to tender the satellite ERP as well as IOT smart city projects. These projects are the wildcards in play. However, with strong government support, I see limited risk /downside for these projects and most likely greater upside in the long run. Singtel also has diversified source of operating revenue, from its complementary smartphone sale and distribution business, world cup hosting rights, telcos wallets and payments, ICT business which should severely limit the downside risks presented from the other telcos.

https://sbr.com.sg/telecom-internet/news/singapores-new-mvnos-cause-headwinds-telcos

http://boringinvestor.blogspot.com/2018/04/will-mvnos-cannibalise-telcos-business.html#comment-form

https://research.sginvestors.io/2018/06/telecom-sector-singapore-m1-singtel-starhub-dbs-research-2018-06-26.html

https://research.sginvestors.io/2018/06/singtel-investor-day-ocbc-investment-research-2018-06-20.html

Financial Performance - Reality Check

Looking at the numbers prior to the story, the numbers paint a very dismal picture which is starkly in contrast with the rosy picture envisioned by the chairman and CEO. Discounting the one off sharp increase in earnings due to divestment of Net-link, underlying net profit and EPS has been deteriorating over the years since 2014. There is fundamental weakness present in the company rather than market being overly pessimistic in its prospects.

Income Statement

The decrease in revenue is corresponded by a decrease in cost of revenue.

The general and administrative expenses is not well managed.

There is a general decrease in operating income but sharp increase in other income (Netlinx divestment in 2018)

Balance Sheet

Increase in debt, partially paid down in 2018.

Increase in retained earnings and conducting of share buyback.

General increase in interest expense.

General continual drawdown in cash.

Increase in assets, PPE, intangible assets and goodwill. Increasingly significant increase in goodwill and intangibles.

High and increasing Capex is a consistent weigh down on profitability and cash flow. Such is the nature of the traditional telco business. Compared to virtual telcos whom act as middleman business and not incur heavy capex, traditional telcos employ many engineers and technicians to maintain its infrastructure.Despite the use of EBITDA in the management discussion, it fails to address the high non cash depreciation expense incurred by the company.

Operating Cash flow and underlying profit paints a more realistic picture of the state of the company.

Cash flow statement

General increase in dividend paid

Free cash Flow has been improving and debt has been pared down which is good news, and excess funds has been returned to shareholders via special dividends.

Cash Flow from operations generally decreasing except for 2018

Continual Negative and general increase cash flow from investments (Investment into capital infrastructure)

Continual negative and increasing general increase in cash flow from financing.

Significant exchange rate exposure.

Huge fluctuation in cash position.

Performance Ratio Analysis

General decrease in ROE and ROA

Stable DPS due to fixed dividend policy. Management announced the intention to keep dividend fixed but there is a probability that operating income cannot sustain the fixed dividend policy.

EPS generally increasing.

Gross Margin and Net profit margin is still good and generally improving, but there is significant decrease in operating profit margin.

Asset turnover is deteriorating

Financial leverage is generally increase but improved (paid down) in 2018.

Extended Dupont Analysis

Utilising DuPont analysis on its ROE, its heavy accumulation of assets did not correspond with improved asset turnover and efficiency, and in actual fact there is lower asset turnover and lower ROA. It's financial leverage has been deteriorating over the years until 2018 when it used it's Netlink proceeds to pare off its debt position. It's net profit margin has also been declining. Nonetheless, past information cannot fully account for future performance.

Qualitative analysis

Looking at the qualitative statements, Amobee (digital marketing arm) has turned EBITDA positive and management suggested it may be spinning off this asset in the next 2-3 years after the gestation period. It is good that Singtel is not diwosifying. The threat of the price war still looms and too many cards are still unturned. It is too early to average down until more information is available.

With regards to the TV business, the hype of the world cup effect might be widely visible all around Singapore but it's financial contribution is largely insignificant to the bottom line. The digital TV initiative by the government to allow Singtel and star-hub to horde the lines and free up bandwidth, I do not know what to make of it yet.

Singtel is also digitalizing its operations to lower costs and improve customer experience. For example, automating certain transactions such as sales and query handling through online/mobile app platforms allows Singtel to reduce customer service headcount and improve speed of service. Through a quick visit to the Singtel shops, I can see an ATM like feature on the ground but customers are not up-taking it up yet.

Trustwave, which is Singtel’s cyber security arm, is now one of the top five global cyber security players among telcos. I can see it as strategically important but I have no idea what is the growth prospect in this particular area.

Despite the recent share correction and market weakness, stocks in general still have not dipped to truly attractive levels. The margin of safety is not sufficient for Singtel and I rather buy into a giant grizzly bear supported by strong bottom up performance.This stalwart with a slow growth story will need a few years to play out and there might be further corrections ahead. I must work with the assumption that what have gone low can still get lower and technical analysis is merely a fickle tool. Any further investment at present is purely speculation and there is a possibility that I will be overexposed to a deteriorating company.

Looking at the qualitative statements, Amobee (digital marketing arm) has turned EBITDA positive and management suggested it may be spinning off this asset in the next 2-3 years after the gestation period. It is good that Singtel is not diwosifying. The threat of the price war still looms and too many cards are still unturned. It is too early to average down until more information is available.

With regards to the TV business, the hype of the world cup effect might be widely visible all around Singapore but it's financial contribution is largely insignificant to the bottom line. The digital TV initiative by the government to allow Singtel and star-hub to horde the lines and free up bandwidth, I do not know what to make of it yet.

Singtel is also digitalizing its operations to lower costs and improve customer experience. For example, automating certain transactions such as sales and query handling through online/mobile app platforms allows Singtel to reduce customer service headcount and improve speed of service. Through a quick visit to the Singtel shops, I can see an ATM like feature on the ground but customers are not up-taking it up yet.

Trustwave, which is Singtel’s cyber security arm, is now one of the top five global cyber security players among telcos. I can see it as strategically important but I have no idea what is the growth prospect in this particular area.

Despite the recent share correction and market weakness, stocks in general still have not dipped to truly attractive levels. The margin of safety is not sufficient for Singtel and I rather buy into a giant grizzly bear supported by strong bottom up performance.This stalwart with a slow growth story will need a few years to play out and there might be further corrections ahead. I must work with the assumption that what have gone low can still get lower and technical analysis is merely a fickle tool. Any further investment at present is purely speculation and there is a possibility that I will be overexposed to a deteriorating company.

Comments

Post a Comment