The tale of 2 props

The Tale of 2 Props

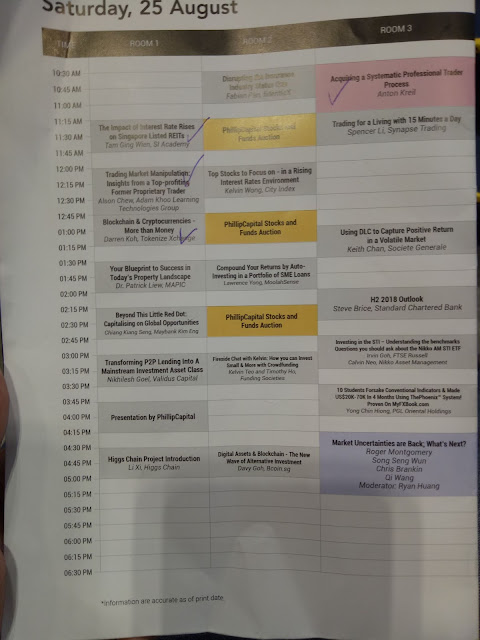

I went to the Suntec Invest talk on 25 Aug 18. I preplanned my itinerary to prioritise on the choice speakers that I am interested to hear about,

as well as to observe the innovations in the retail investment

landscape if any .

Anton Kriel was one of the top speakers on my list .

Although I have no insight in the trading strategies he is espousing

(long short portfolio) and his trading performance , his interpretation

of the reality behind the financial illusion the industry is propagating

is sombre and refreshing. I chanced upon the lectures by this maverick

ex-Goldman trader a few years ago while I was practising dummy trading

for my university project during the Cyprus crisis. Cutting through the

smoke and furore generated by the online forums and news casters, I

discovered fake news and conflict of interest is a very real thing

indeed, and an entire industry is monetary incentivised to generate

excitement and churn for the retail brokerage industry without bringing

meaningful returns to the bottom line of the retail traders. His influence ironically made me shy away from the short term trading route. However, it will be great to know

more about my counterparty perspective (institutional investors) while

they are trading against me.

The gist of his 30 mins talk is only a 2 page

presentation of his entire lecture. The 2 hour video I highlighted covered much more meat.

Top down analysis based on macro

themes.

Entry and exit in tranches throughout a 1-3 month time horizon

before branching out to shorter term trading or longer term buy and

hold.

Setup position limit and target risk before setting a realistic

expected return.

Not all investor like maximised return over risk /

volatility.

Dependent on fund mandate. Importance of generating a

consistent and systematic process.

Proper scheduling and proper

allocation of time for trading research.

Alignment of fundamentals and

technicals in order to initiate a position.

I had a short chat with Anton Kriel (within a small group). Personally, I found him to very eloquent, ruthlessly smart about trading psychology as well as immensely charismatic. Several of his key points (1-3 months timing horizon) seems to be aligned with what the professional traders I once talked with. However, based on my personal experiences with communicating with traders, as well as reading Wall street literature such as <Enron The Smartest Guys In The Room> , <Why I Left Goldman Sachs: A Wall Street Story>, and <Liar's Poker> by Michael Lewis, I can never really know if the same trader is utilising me as a counterparty and trading against me. His course fee is pretty exorbitant and he is a genius in pricing and branding his materials for a premium. Personally, I believe he is a smart trader and businessman, but due to differences in my investing / trading philosophy, I believe his ideas are great to know but not worth the premium paid.

The second proprietary trader talk I attended is by Alson

chew, who is currently partnered with Adam Khoo's investing college. His knowledge of market manipulation is staggering especially in the Singapore context, and he seem to be taking pointed shots at the validity of efficient market hypothesis. Some of the key points he highlighted is as follows.

Do not trust order book, block trades booked by market makers. Free Market Depth by the SGX can be easily inflated / manipulated by market makers and it can give illusions of high buy /sell volumes.

Reverse engineer of trading indicators to trade against retail investors

Print candlestick charts for distribution list to generate churn

Fallacy of

momentum trading. Possible for market makers to control price and volume (premise of Dow theory)

to affect technical analysis

Create

false supply and demand volume - accumulation / divesting of existing

position.

In the short term, prices controlled by the market makers and

not fundamentals

For retail trading, understand that you are trading

against your broker / counterparts and people whom move the market. They

are masters of market sentiment. (offloading position)

It has been a very enriching experience and a good place to spend the earlier half of my day. I also managed to pick up some brochures regarding to corporate bond ETFs, and had a enjoyable time exploring the 893FM as well as the investing note booth. I will look forward to blogging about similar seminar / booths in this blog while waiting for any catalyst / market changes.

Comments

Post a Comment