Limit Break! The 100K Mark!

Limit Break! The 100K Mark!

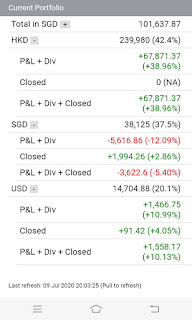

While most Singaporeans are busy pondering over the future of the nation amid cooling down day, I was ecstatic over something different entirely. I broke the SGD100K mark!

Breaking the portfolio threshold beyond this resistance line at the age of 28 is something I am immensely proud of. Considering I graduated with negligible savings and did not land a high paying job, the portfolio is built up from scratch entirely through my own research and frugal savings. Although the value/GARP framework did not bear fruit for the first 2 years of investing (a result of dollar cost averaging in the STI ETF), my investment results improved immensely after the value in Ascendas India Trust and Ascendas REIT are realized by others.

While most Singaporeans are busy pondering over the future of the nation amid cooling down day, I was ecstatic over something different entirely. I broke the SGD100K mark!

Breaking the portfolio threshold beyond this resistance line at the age of 28 is something I am immensely proud of. Considering I graduated with negligible savings and did not land a high paying job, the portfolio is built up from scratch entirely through my own research and frugal savings. Although the value/GARP framework did not bear fruit for the first 2 years of investing (a result of dollar cost averaging in the STI ETF), my investment results improved immensely after the value in Ascendas India Trust and Ascendas REIT are realized by others.

After I have gathered enough confidence to venture beyond Singapore to HK and US markets, my investment performance improved tremendously. I do not have any evidence that foreign markets are more efficient than Singapore markets, but the same framework of investing brought out-sized returns in HK/China and US, but did not seem to offer similar results in Singapore. From a pure bottom up fundamentals and valuation analysis, I took a nibble of the cheaper stocks in the pricey US market and allocated substantial amounts of my pent up warchest heavily into the battered HK/CN market during the Feb-July period and was rewarded immensely for it.

Ignoring the ominous chanting from pseudo value investors whom seek to

market time or changed their professions to macro-economists / macro forecasters / risk managers / tech-savvy investors at

the recent crash, I stuck to a disciplined plan of buying into the

fundamentally good stocks that are battered down. Although there is a likelihood of a second wave of Covid or crisis of confidence that could batter the stock market, I have faith that the fundamentally strong stocks I have chosen can survive the crisis and can prosper in the period during and after the crisis. There is no question that geopolitical tensions can easily reduce my relative wealth by a substantial amount, and I look forward to allocating my residual warchest if such an opportunity happens.

Investors gawking at the Federal Reserve fixing the economy

Portfolio Decisions

To conserve my warchest and to deploy conservative leverage (CPF)

1) I initiated a mid conviction position into Frasers Centerpoint Trust at the price of SGD 2.50 on 06/06/20. There is always a risk of second wave of Covid hitting the malls, but the fundamentals of the REIT <Superior geographical location, strong footfall, secured tenant base> made this counter too cheap to ignore. I seek to average down if there are further corrections or developments in the Singapore situation.

2) I initiated an high conviction position into SGX at the price of SGD 8.25 on 12/06/20 due to my belief there is no deterioration in the fundamentals of the stock. The presence of high volatility events like Singapore elections, US elections, geopolitical tensions, low returns environment will be a boom to the securities buy/sell volume as well as the demand for derivatives. Although I largely prefer HKEX growth prospects, the valuations are demanding compared to the cheaper SGX.

Warchest deployment

3) I initiated a high conviction position into the HK tracker fund at the price of HKD24.92 as foreign commentators mourn over the loss of freedom in the HK market. A hard look at Singapore revealed the fact that an authoritarian government which can restore order to the divided community can easily restore the country to a prosperous state, and business owners are more interested in productivity and order compared to civil rights movements. The constituents are fundamentally strong but I do not have special insight / scuttlebutt analysis on the ground behavior, leading me to make such a decision.

Conclusion

There is always something to worry about. Bull markets climb a wall of worry.

There is always something to worry about. Bull markets climb a wall of worry.

No one can predict whether the Trump rally on Wall Street will be subjugated by the Trump rally (Protest) in main street.

No one can predict stock prices using backdated models / back-testing and ignore the fundamental changes in the economy.

No one can be a good investor if he sticks to the dogma <I have already made up my mind, don't confuse me with facts.>

No one can be a good investor if he sticks to the dogma <I have already made up my mind, don't confuse me with facts.>

Put your best foot forward and make the best decisions onward!

Looking good!

ReplyDeleteCongrats!

Thanks for the encouragement! Hope to compound this further. :)

Delete